Posted October 20, 2025

By Matt Insley

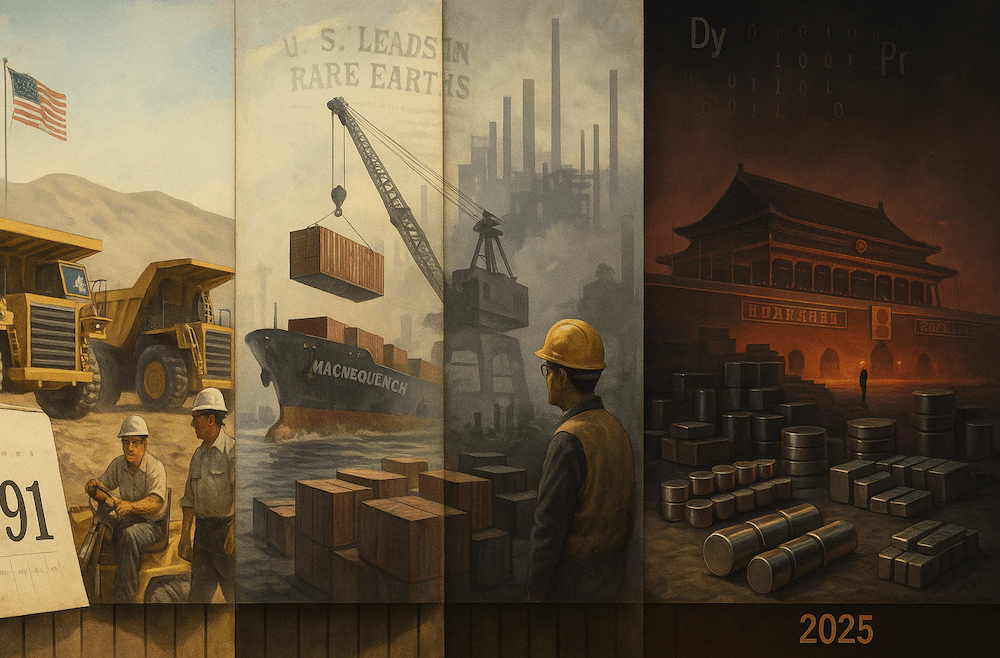

1991 → 2025: How China Won Resource Dominance

Just three decades ago, the United States sat atop the global rare-earth industry.

From a sprawling mine in California’s Mojave Desert, the Mountain Pass operation supplied most of the world’s demand for the 17 elements that make up the backbone of modern technology — for magnets, batteries, wind turbines, fighter-jet guidance systems and so much more.

Then that dominance slipped away. What followed was one of the most consequential industrial surrenders of the modern era — one that left Beijing with near-total control of materials vital to the global economy.

The pivot began as American policymakers focused on the end of the Cold War, but China’s leadership was already mapping out a different kind of power play.

In 1991, Beijing formally declared rare earths a “strategic resource” and passed laws that barred foreign firms from owning or operating Chinese deposits.

Tax rebates and cheap financing encouraged domestic producers to flood the market. The result was devastating for higher-cost American competitors.

Your Rundown for Monday, October 20, 2025...

The High Cost of Complacency

At the time, the U.S. had no coordinated industrial policy to match China’s long-term strategy. Washington largely viewed rare earths as just another commodity — subject to market cycles, not national planning. That laissez-faire attitude collided head-on with Beijing’s state-directed model.

In 1995, Chinese state-linked firms bought the rare-earth magnet business that General Motors had developed under the name Magnequench. The deal was approved by U.S. regulators.

Within years, production lines and even American engineers had been transferred to China. As domestic plants shut down, China rapidly built a complete rare-earth supply chain — from ore to high-value finished magnets.

By the mid-2000s, the U.S. rare-earth industry had been hollowed out. Mountain Pass was shuttered amid environmental concerns and falling prices.

With virtually all processing capacity now in Chinese hands, China’s share of global production rose to roughly 97%. The United States — once the uncontested leader — was forced to rely almost entirely on imports from its new rival.

China then used its advantage to lock-in dominance. Beginning around 2005, Beijing imposed export taxes and quotas that made rare-earth supplies for foreign manufacturers both scarce and expensive.

Companies that needed steady access — from auto parts makers to electronics firms — moved their factories to China.

When the Obama administration, the European Union and Japan challenged those quotas at the World Trade Organization, China lost the case in 2014 but responded by briefly flooding the market again, driving down prices and forcing Western miners into bankruptcy.

Molycorp, the American company that tried to resurrect Mountain Pass through its “Project Phoenix,” went bankrupt in 2015.

The mine later reopened under MP Materials, which relied on financing from China’s Shenghe Resources to resume production. Even today, much of Mountain Pass’s output still ends up in China for processing.

By the early 2020s, Washington recognized the depth of its dependence. The Biden and Trump administrations each pledged billions for domestic refining and magnet-making projects, including a Texas refinery by Australia’s Lynas Rare Earths.

Yet Beijing continues to outmaneuver the West — expanding output, undercutting prices and restricting the export of processing technology.

In 2025, China went further, ordering that companies abroad using Chinese rare-earth materials must seek its approval before exporting their finished magnets. The White House calls the move “deeply concerning.”

The message is unmistakable: decades of neglect allowed China to turn a once-U.S.-dominated industry into a geopolitical weapon.

But the U.S. is no longer standing still. New refineries in Texas and California, fresh Pentagon funding, and a push for domestic magnet production suggest Washington finally sees rare earths for what they are — a foundation of national power and a race America still intends to win.

Market Rundown for Monday, October 20, 2025

S&P 500 futures are up 0.30% to 6,720.

Oil is down 0.75% to $57.10 for a barrel of WTI.

Gold’s up 2% to $4,296.60 per ounce.

And Bitcoin is up 1.85% to $111,050.

Rare Earth Risks

Posted October 17, 2025

By Matt Insley

Jim Rickards: The Climate Cover-Up

Posted October 15, 2025

By Matt Insley

Censor First. Profit Later.

Posted October 13, 2025

By Matt Insley

The “Mamdani Effect” Could Be Hochul’s Undoing

Posted October 10, 2025

By Matt Insley

Paper Promises Fail, Real Assets Prevail

Posted October 08, 2025

By Matt Insley