Posted October 06, 2021

By Aaron Gentzler

A Crypto Ban: “Up to Congress”

SEC Chairman Gary Gensler has lobbied lawmakers to grant the SEC more authority to regulate cryptocurrency -- presumably to protect crypto investors.

"I think that many of these tokens do meet the tests of being an investment contract or a note or some other form of security that we bring them within the investor protection remit of the SEC,” Gensler said yesterday at a House of Representatives hearing.

That said, he claims the SEC has no plans to follow in Beijing’s footsteps, banning crypto. “No,” he said when questioned.

While adding this caveat…

“I mean, that would be up to Congress," Gensler said.

"I think that the challenge for the American public is that if we don't oversee this and bring in investor protection, people are going to get hurt."

But some major banks are already preparing for the mainstream to embrace crypto...

Send your opinions to, TheRundownFeedback@StPaulResearch.com

Your Rundown for Wednesday, October 6, 2021...

Major Banks and Crypto Custody

“The race to cater to institutional investors who want to wager on cryptocurrency is heating up,” says an article at CNBC.

Just yesterday, the fifth-largest retail bank in the country -- U.S. Bank -- announced fund managers would have access to its crypto custody service.

“The offering will help investment managers store private keys for bitcoin, bitcoin cash and litecoin with assistance from sub-custodian [New York Digital Investment Group.”

And assistance with other coins, including ethereum, is forthcoming, according to U.S. Bank’s Gunjan Kedia.

“Our clients are getting very serious about the potential of cryptocurrency as a diversified asset class,” Ms. Kedia says. “I don’t believe there’s a single asset manager that isn’t thinking about it right now.”

In fact, Bank of New York Mellon, State Street and Northern Trust “have also announced plans to custody digital assets,” says CNBC.

“What we were hearing across the board, is that while every currency might not survive -- there may not be room for thousands of coins -- there’s something about the potential of this asset class and the underlying technology that would be prudent for us to stand up support for it,” Kedia says.

But the holy grail of crypto? Something retail and institutional investors alike are awaiting? “If and when the U.S. Securities and Exchange Commission approves a bitcoin ETF, demand is expected to rise,” CNBC notes.

“We have a lot of funds who are hoping to invest in ETFs,” Kedia adds. “Some literally want custody contracts signed the day the SEC approves an ETF.”

[Readers: What's the likelihood you would invest in a crypto ETF? Is that the validation you would need to invest in crypto?]

Market Rundown for Wednesday, Oct. 6, 2021

S&P 500 futures are down 1% to 4,295.

Oil’s down too 1.5% to $77.71 for a barrel of West Texas Intermediate.

Gold is churning at just under $1,600 per ounce.

Bitcoin, on the other hand, is up 6% to $54,055.

Send your comments and questions to, TheRundownFeedback@StPaulResearch.com

Hope you have a wonderful Wednesday; we’ll talk more later this week…

For The Rundown,

Aaron Gentzler

Editor, The Rundown

TheRundownFeedback@StPaulResearch.com

Americans First

Posted July 03, 2025

By Matt Insley

Could Trump Deport Elon?

Posted July 02, 2025

By Matt Insley

The Daredevil in Pink Tights

Posted June 30, 2025

By Matt Insley

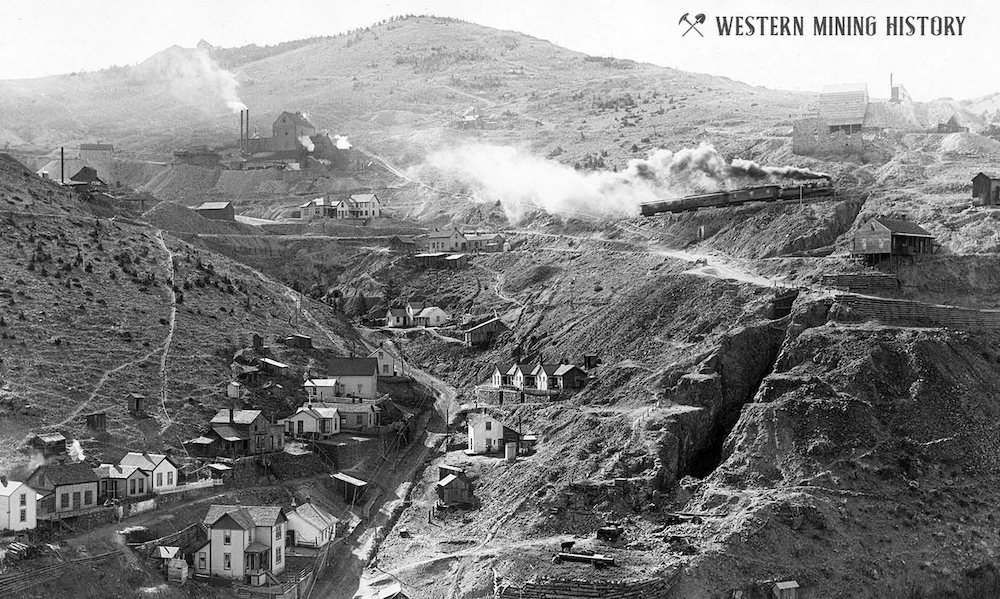

Star Geologist On “Birthright” Companies

Posted June 27, 2025

By Matt Insley

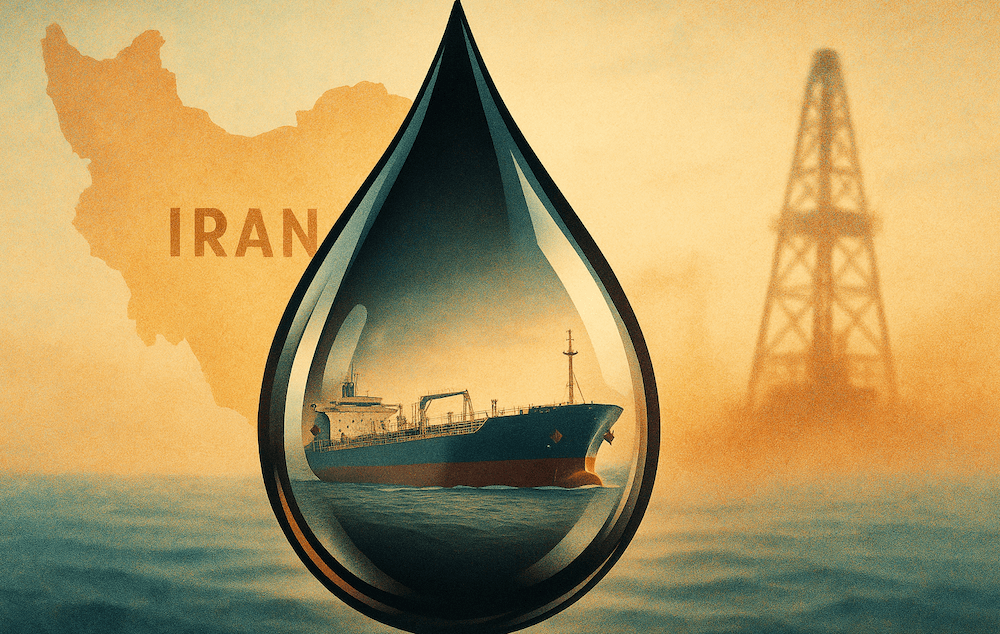

Iran’s Energy Chokepoint: Strait of Hormuz Fallout

Posted June 25, 2025

By Matt Insley