Posted September 03, 2025

By Matt Insley

A National Housing Emergency

Treasury Secretary Scott Bessent, speaking on Labor Day to the Washington Examiner, said the Trump administration is debating declaring a national housing emergency “this fall.”

Well it’s about time!

Let’s break it down… Where’s the emergency and what can the White House do about it?

Hold on to your seat dear reader… Here come some cold, hard stats.

Mortgage rates remain stubbornly, though not historically, high. At writing, according to the St. Louis Fed, the average 30-year mortgage rate is 6.56%.

Flash back to the summer of 1990 — the average mortgage was just over 10%.

And God forbid you remember the 80s — in the fall of 1982 mortgage rates were over 15%.

At the risk of oversimplification, and good for Sec. Bessent for pointing it out, the American housing market right now does NOT have…

- Enough housing supply…

- Enough household formation (folks getting married and starting families)…

- Enough sales of existing homes to feed the engine of buyers and make up for relatively thin supply of new home construction in many markets.

What do we have enough of?

Read on for more…

Your Rundown for Wednesday, September 3, 2025...

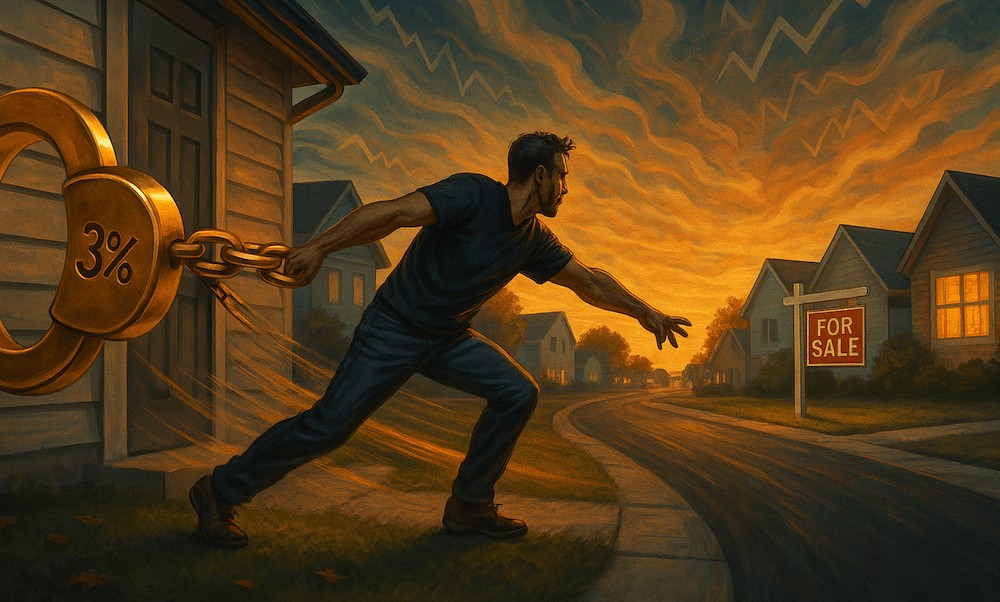

3% Mortgages and the “Golden Handcuffs” Problem…

Ok, so we don’t have enough houses, existing home sales, new home construction, or household formation… What do we have plenty of in September 2025?

Homeowners with 3% and sub-3% mortgages who are sitting pretty, with no incentive or intention to move anytime soon.

The law of unintended consequences: After a decade-plus of ZIRP and then the bonanza of COVID-era stimulus, the U.S. housing market is warped, twisted, out of whack.

Think about it…

6.56% may not look terrible in the context of 40-years of mortgage trends, but it’s ugly as sin compared to post-COVID era policy that saw sub-3% mortgages up for grabs.

This is the “golden handcuffs” argument… It’s more psychological than lumber prices, labor costs, permitting or tariffs… but powerful nonetheless.

Few people with ultra low mortgage rates want to give up their amazing position, keeping some would-be homesellers from listing their properties.

This reduces supply, upsets would-be homebuyers who see less inventory available and substantially more expensive borrowing costs than they remember just a few years ago.

Add it all up and you get, in Secretary Bessent’s description, a “national housing emergency.”

Again, good for him for actually saying it in plain language.

Does the expectation of lower rates fix the problem?

Not on its own. And it won’t be a fast fix even if rates drop substantially.

Expanded tax credits? Federal incentives? More savings and discipline from prospective homebuyers?

Write in and tell us, reader. If you could wave your magic wand and thaw the housing market in America, what would you do?

Market Rundown for Wednesday, September 3, 2025

S&P 500 futures are up 0.35% to 6,450.

Oil is down 2.20% to $64.10 for a barrel of WTI.

Gold’s up 0.50% to $3,611.90 per ounce.

Bitcoin is up 0.85% to $111,545.

Department of War (Crimes)

Posted December 05, 2025

By Matt Insley

Americans Are Drowning All Around Us

Posted December 03, 2025

By Matt Insley

Trump Rewrites Ukraine’s Peace Plan

Posted December 01, 2025

By Matt Insley

Nvidia’s Uncertain Future

Posted November 26, 2025

By Matt Insley

Dead Men Can’t Trade

Posted November 24, 2025

By Matt Insley