Posted December 12, 2025

By Matt Insley

A Silver Bug Moment

For decades, silver bugs have talked about how the price is being artificially suppressed. But they assured us that eventually, this price suppression scheme would fail and the price of silver would rocket higher.

Is that what’s happening today? Perhaps.

The theory says that global governments want to hold down the price of silver and gold because otherwise their fiat currencies look bad.

Think about it. Right now, with gold and silver flying higher, everyone is immediately wondering what’s wrong with the dollar (and other fiat money).

The answer to what’s wrong with the dollar is that there’s too much debt and deficit, of course. The Fed is about to lower rates and has announced a $40 billion a month t-bill buying scheme. This is essentially debt monetization.

So the government certainly has an incentive to suppress the price of gold. But have they been? And does it matter? Let’s dig in…

Your Rundown for Friday, December 12, 2025...

What’s Causing the Silver Spike?

Silver has soared from $29 at the start of the year to over $64 today. A very impressive move. But not uncommon for silver historically. During the 1970s silver shot from a low of around $1.50 to $50.

From 2009 to 2011 silver soared from $10 to $50. This metal can move.

The 1970s bull run was fundamentally fueled by inflation. Yes, the Hunt Brothers also attempted to corner the market using futures contracts, but that was really only part of the whole picture.

From 2009 to 2011, that move was also fueled by money printing and fears over inflation.

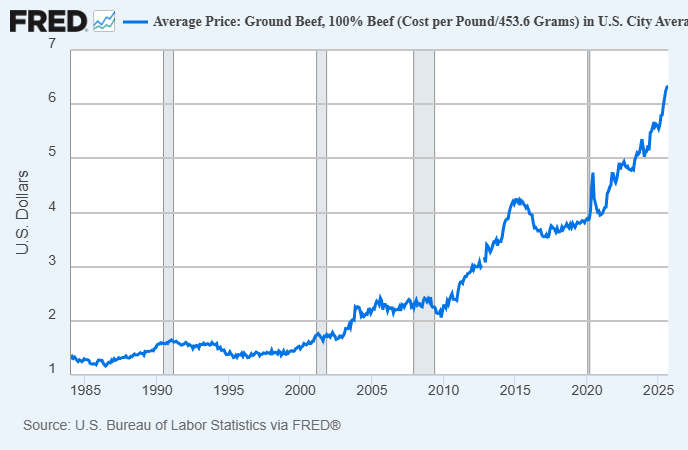

And today, there’s no doubt inflation is also playing an important role. Take a look at the chart below. It’s not an AI stock. It’s the price of U.S. ground beef.

Investors are looking for ways to preserve their wealth from what lies ahead. Everyone seems to instinctually know that we’re building towards some significant monetary/financial reckoning. And historically, silver is one of the best ways to play it.

Demand for silver is also soaring due to industrial uses, particularly solar panels. China’s solar industry is gobbling up around 20% of the entire global silver mine production.

So clearly there are fundamental factors driving today’s move.

Could this also be the end of a decades-long global price suppression scheme? Sure, but it’s very difficult to prove.

We do know that JPMorgan, one of the largest bullion banks, was fined $920 million by US regulators for manipulating the price of gold and silver in futures markets. They did this by “spoofing” bids they had no intention of following through on, moving prices artificially.

So was JPMorgan manipulating markets to suppress the price of precious metals, or simply to make money? Or both? We don’t know.

If this is the unraveling of a major price suppression scheme, which seems like a relatively small probability, the price of silver could have much further to run.

But even if it’s not a conspiracy unraveling, the fundamental factors are in place that could drive silver prices much higher over coming years.

Silver bugs are having a moment, and many have been waiting a long time for it. Congratulations, all you silver stackers out there. No matter what’s driving this market, you deserve credit for sticking to your beliefs. And it’s paying off, big time.

Market Rundown for Friday, December 12, 2025

S&P 500 futures are flat at 6907.

Oil is down about .23% to $57.61.

Gold is up $57 to $4,370.

And Bitcoin is up 2.43% to $92,310.

AI’s Y2K Moment

Posted February 25, 2026

By Matt Insley

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley