Posted January 04, 2023

By Matt Insley

A Tech Turnaround in 2023?

Dear Rundown reader,

There’s no doubt about it… 2022 was a doozy!

To confirm that sentiment, you don’t need to look any further than how inflation has ransacked your bank accounts…

Courtesy: U.S. Bureau of Labor Statistics, Visual Capitalist

Click to enlarge

The graphic is based on price changes — from Nov. 2021 - Nov. 2022 — that have strained the budgets of everyday Americans.

Then there’s the widespread devastation to Americans’ investment portfolios…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Wednesday, January 4, 2023...

Tech Turnaround?

According to Gallup’s April 2022 Economy and Personal Finance survey, 58% of Americans own stock.

Which is ironic.

Most investors understand you can’t simply stockpile cash — particularly for retirement — because inflation will quickly nibble away at your nest egg. (See above.)

But the stock market definitely didn’t keep up with inflation last year. Hardly. In fact, in some cases, it did the exact opposite. Or much, much worse…

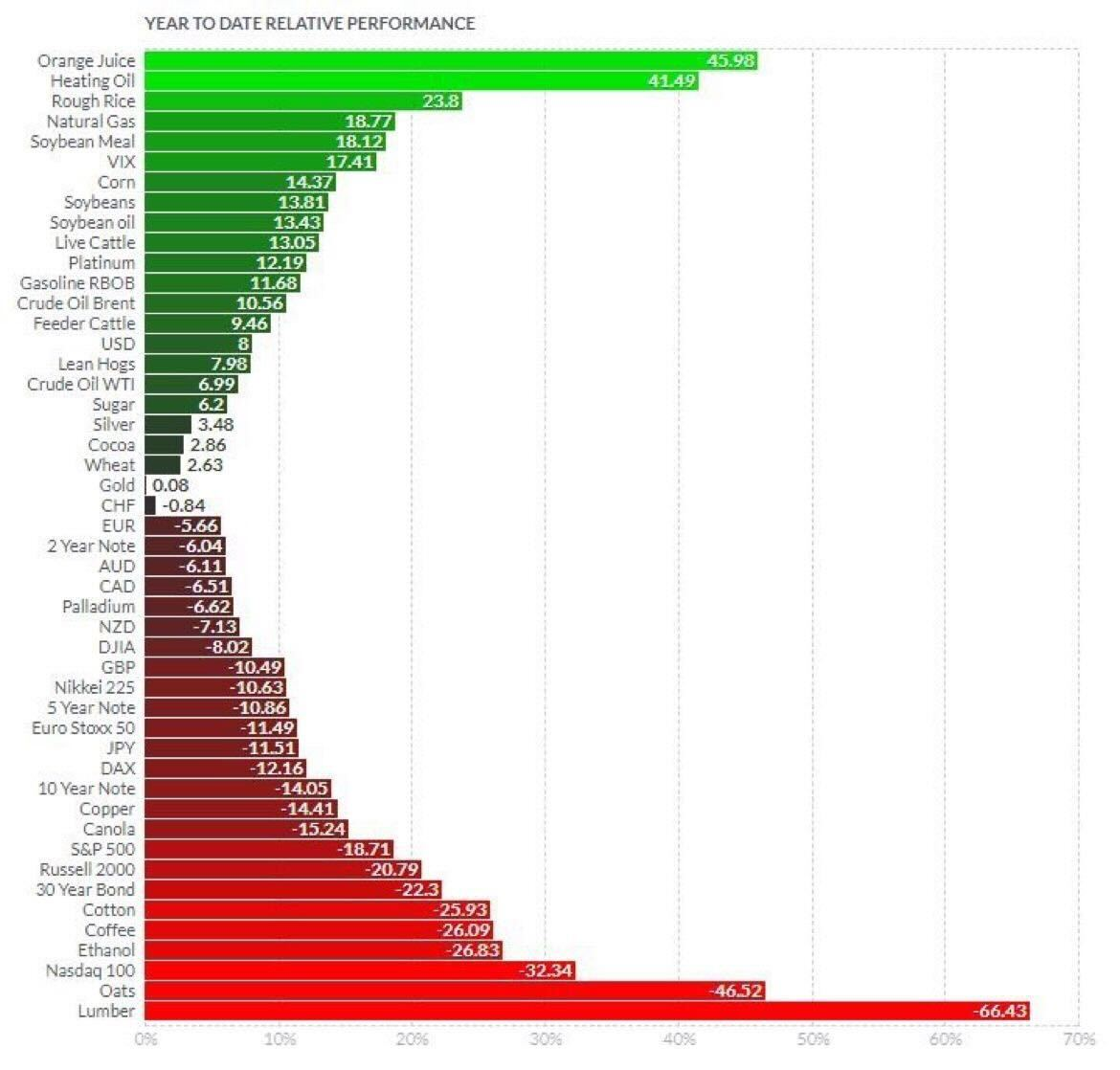

Source: FinViz.com

Out of a basket of commodities, currencies, bonds plus domestic and international stock markets, we extrapolated the following data:

- Dow: -8%

- S&P: -19%

- Nasdaq: -32%

- Gold: 0%

- Oil: 7%

- Dollar: 8%

So, where to from here?

“It was certainly a painful year for tech,” says Paradigm’s technology expert Ray Blanco, “but that could all change this year.

“For starters, if inflation really does cool off, some of these beaten-down tech companies could be in a perfect position to make moves higher.

“That’s not to say that we’ll see every tech company move up and to the left in 2023,” says Ray. “It'll take some careful consideration, but there’s certainly a bull case to be made for select tech names in the new year.

“One angle you could take as a tech investor would be dividend stocks. A company like Intel Inc. (NASDAQ: INTC) is a great example of a dividend tech play that’s worth a look,” he says.

“INTC is knee-deep in a long-term strategy focused on doubling down on manufacturing and regaining leadership in the CPU markets.

“INTC’s dividend yield has rocketed higher to around 5.7%, over three times the yield of the S&P 500,” Ray adds, while concluding: “Many large investment firms will assess their plans and make changes as necessary in the new year.

“A sentiment change sparked by investment firms could really push a market rally,” Ray notes, “especially in the beaten-down tech sector.”

Market Rundown for Wednesday, Jan. 4, 2023

S&P 500 futures are up 0.40% to 3,860.

Oil is down 2.75% to $74.77 for a barrel of WTI.

Gold is up almost 1% to $1,866.30 per ounce.

The same goes for Bitcoin: up about 1% to $16,800.

Send your comments and questions to, feedback@newsyoucanacton.com.

A Hopeful Look Ahead on Inauguration Day

Posted January 20, 2025

By Matt Insley

Hegseth Hearing a Major Win For Trump

Posted January 17, 2025

By Matt Insley

Newsom’s Water Crisis Exposed

Posted January 15, 2025

By Matt Insley

Kash Patel’s Ally in Congress

Posted January 13, 2025

By Matt Insley

Trump’s Plan for the Border

Posted January 10, 2025

By Matt Insley