Posted December 06, 2022

By Matt Insley

Black Friday Retail: “Inflation Mirage”

Is the bottom in for the stock market?

Looking past the day-to-day swings of a percentage point or two — like yesterday’s drop — I asked Sean Ring, editor of our sister publication Rude Awakening.

“I think there is a temporary bottom in. The short answer is yes for now.”

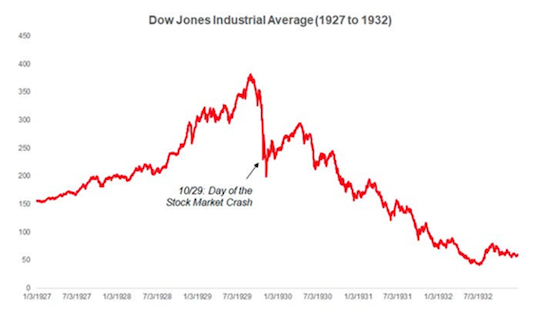

But, Sean went on, there was also a temporary “bottom” at the end of 1920 after the big crash. And then look what happened from 1930 to 1932…

“If you look at the apocryphal news from back then, everyone was throwing themselves out windows during the 1929 crash. That's not true… [from 1930 on] was the part here that hurt everybody,” Sean explained, speaking live on Friday’s installment of Rickards Uncensored.

(If you’d like to catch Jim Rickards’s next live Rickards Uncensored call on Friday, click here to learn more.)

The true economic pain took time to play out.

And there are warning signs we could see a similar pattern play out next year, even if we make it through the holidays in one piece.

To that point, even some of the good economic news reported in recent days by the mainstream financial press is not what it seems…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Tuesday, December 6, 2022...

“Inflation Mirage”

Headlines after Thanksgiving hailed “record” Black Friday retail sales.

That didn’t reflect what I was seeing among friends and family, so I was interested when our macro expert Jim Rickards chimed in on the subject yesterday.

He dubbed the sales numbers an “inflation mirage.”

“Here’s what they’re not telling you… The sales figures and ‘records’ you keep reading about are expressed in nominal dollars. In order to convert to real dollars, you have to subtract inflation from the number presented,” Jim explained.

“For example, the 2.3% gain in Black Friday cyber sales is actually a drop of 5.4% adjusted for inflation. The 5.1% estimated gain in Cyber Monday sales is actually a drop of 2.6% adjusted for inflation.”

And if we look past the “mirage” of that sales data, we have a growing list of things that point to more economic pain coming soon.

“There’s a lot of other data to support a recession hypothesis including declining savings, declining real wages, and increases in credit card balances that are non-sustainable because the cards have limits and the sky-high interest rates eat consumers alive…

“How will consumers pay off credit card balances with 20% interest if real wages are declining 3% on an annualized basis? They won’t.”

Market Rundown for Tuesday, Dec. 6, 2022

S&P 500 futures are down 0.35% to 3,980.

Oil is down 0.60% to $76.45 for a barrel of WTI.

Gold is up 0.40% to $1,788.90 per ounce.

And Bitcoin is up 0.30%, just under $17,000.

Send your comments and questions to, feedback@newsyoucanacton.com

Ex-DOJ Lawyer Calls for Hunter’s Pardon

Posted November 29, 2024

By Matt Insley

Trump’s Secret List of Cabinet Contenders

Posted November 27, 2024

By Matt Insley

Trump’s Timeline Mirrors Reagan’s First Term

Posted November 25, 2024

By Matt Insley

Trump’s Day-One Executive Orders

Posted November 22, 2024

By Matt Insley

Joe Biden’s Duck and Coverup

Posted November 20, 2024

By Matt Insley