Posted January 10, 2023

By Matt Insley

Brazil In Chaos

Despite hyperbolic headlines predicting the “end of crypto,” James Altucher forecasts some big market-moving catalysts for crypto — and DeFi — in 2023.

Speaking directly to the elephant in the room, James says: “The FTX news was the worst news… It doesn’t really get worse.” Yet he notes: “BTC and ETH have already bounced 15–20% off post-FTX lows.”

Which is heartening news for crypto and decentralized finance (DeFi) believers. And here’s more good news for crypto in 2023…

- “Fidelity allows people to buy BTC and ETH directly: That’s 40 million new people who never bought crypto before who can now buy it via one click,” he says

- “The billion user theory: The world wide web had 1 billion users in 2005. Two years before that, in 2003, internet stocks began to rally. Most people expect crypto to top 1 billion [investors] by 2025

- “Seventy percent of Bitcoin wallets are underwater: This doesn’t sound like a good thing,” says James, “but, apparently, every time this has happened before, a new crypto bull market starts

- “The Fed pivot: It’s hard for dollar-priced assets to go up when interest rates are going up,” James says. “If [the Fed] actually pivots (which is likely to occur mid-2023), then crypto should go up quite a bit.”

“I expect within the next 18–24 months we’ll start to see a transformation of DeFi and crypto,” James forecasts. “I believe we can expect 2023 to be a year where we will begin to see early signs of DeFi’s — including crypto’s — real-world potential.”

Moving on now to a powder-keg situation in South America…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Tuesday, January 10, 2023...

Brazil In Chaos

If you’ve been following the news at all, you’ve probably seen alarming images emerging from Brazil, the fifth-largest country in the world by area. (Parenthetically, it’s the sixth-largest according to population.)

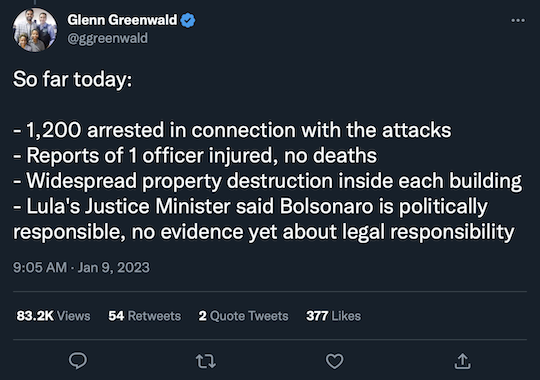

While we try to get a handle on the situation there — excuse us if we don’t trust the mainstream’s interpretation of events — we offer these quicktakes from Brazil-based independent journalist Glenn Greenwald.

Here’s breaking news from the country as of Sunday, January 8…

And then the aftermath on Monday…

That’s all we’re going to report today as we sort through the noise. We’ll write something more comprehensive about the situation tomorrow.

Stay tuned.

Market Rundown for Tuesday, Jan. 10, 2023

S&P 500 futures are down 0.25% to 3,900.

Oil is up 0.40% to $74.95 for a barrel of WTI.

Gold’s moving sideways, a couple dollars under $1,880 per ounce.

And Bitcoin’s up 0.35% to $17,280.

Send your comments and questions to, feedback@newsyoucanacton.com

Canary in the Car Lot

Posted April 26, 2024

By Matt Insley

Bombs Away (Taxes, Middle East and More)

Posted April 24, 2024

By Matt Insley

Power Pinch

Posted April 22, 2024

By Matt Insley

Iran Strikes Back?

Posted April 19, 2024

By Matt Insley

Tesla’s in Critical Condition

Posted April 17, 2024

By Matt Insley

![[Canceled] Ticket to Middle-Class America](http://images.ctfassets.net/vha3zb1lo47k/AlNAIm6fREH8aYZIRTigU/7bc493c0f095aa8a667d518de3af422a/shutterstock_86828824.jpg)