Posted October 13, 2025

By Matt Insley

Censor First. Profit Later.

When Google’s parent company Alphabet admitted last month that senior Biden administration officials had “conducted repeated and sustained outreach” urging YouTube and Google to remove or suppress certain COVID-related content — even when that content didn’t violate company policy — it confirmed what many of us suspected all along.

The White House wasn’t just “suggesting” moderation. It was leaning on tech giants to carry out political aims — and the companies complied.

According to a September 23 letter to Rep. Jim Jordan, Alphabet acknowledged that Biden officials “pressed” the company on user-generated content and “created a political atmosphere that sought to influence [its] actions.”

The House Judiciary Committee called it what it was: government “jawboning” — the kind of soft coercion that lets politicians skirt the First Amendment and control the flow of information.

And to be completely fair…

- Under Biden, the message was: conform or face the regulator’s hammer. Under Trump? The risk is reputational backlash and possible antitrust retribution for being “too woke.”

Here’s the irony: that pressure may have actually helped Big Tech cement its place at the top of the stock market.

Your Rundown for Monday, October 13, 2025...

Compliance Pays

Under Biden’s regime, the so-called “Magnificent Seven” stocks — Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla — became almost untouchable.

These seven stocks made up nearly 30% of the entire S&P 500 by late 2023, a stunning concentration of power.

For social-media firms like Alphabet and Meta, compliance came with hidden perks. By bowing to Washington’s demands, they avoided harsher regulation, kept antitrust cases at bay and reinforced their dominance as gatekeepers of online discourse.

In plain terms, censorship wasn’t free speech’s only casualty. It also warped the market.

Start-ups and smaller platforms that refused to play along — think Parler, Rumble or Gab — faced payment-processor cut-offs, app-store bans and advertiser boycotts. That cleared the field for the incumbents.

And investors rewarded the survivors. Alphabet’s market cap swelled back above $2 trillion this year, and Meta has nearly tripled from its 2022 lows. The message is clear: bend the knee and prosper.

From a financial standpoint, this episode underscores how politics has become a fundamental risk factor for tech stocks. Social media giants have learned to read the political winds.

Alphabet’s confession doesn’t just reveal bias; it exposes a business model built on appeasement. For years, Big Tech has operated as an informal arm of the administration in power, suppressing information when told and collecting record profits in return.

From a financial standpoint, this episode underscores how politics has become a fundamental risk factor for tech stocks. Social media giants have learned to read the political winds.

That arrangement may please investors in the short term, but it carries long-term consequences. Once companies learn that pleasing Washington is more profitable than honoring shareholders, real innovation dies — and free speech goes with it.

Investors should pay attention. When government pressure can move content decisions, it can move markets too. It affects user growth, ad revenue and the very structure of competition.

Market Rundown for Monday, October 13, 2025

S&P 500 futures are up 1% to 6,665.

Oil is up 1.35% to $59.65 for a barrel of WTI.

Gold is up 2.35% to $4,095 per ounce.

And Bitcoin’s at $114,350.

ROTFH: Rolling on the Floor Headless

Posted October 21, 2025

By Matt Insley

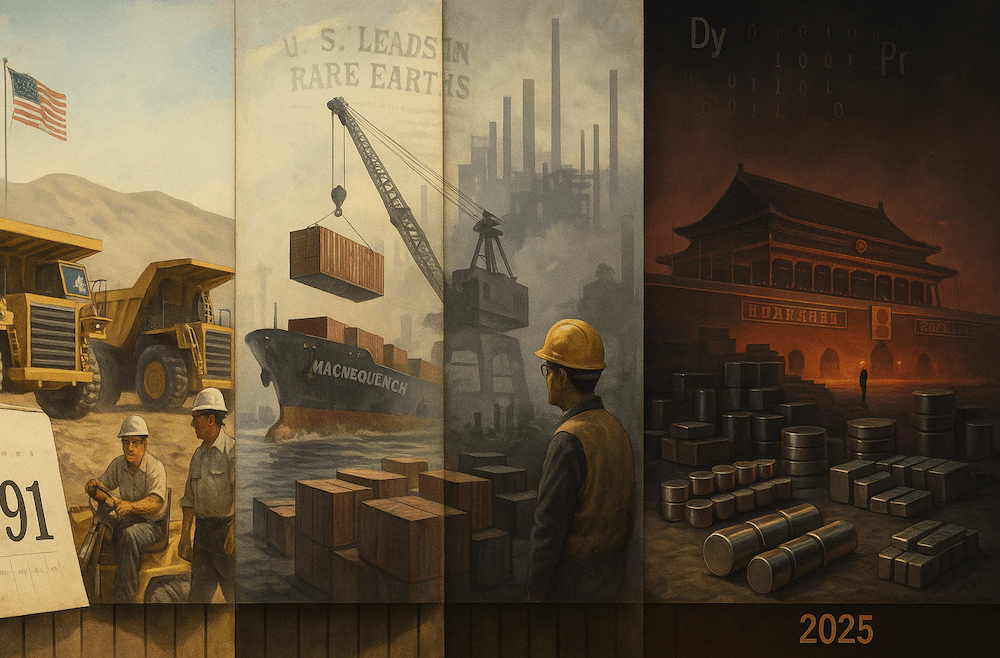

1991 → 2025: How China Won Resource Dominance

Posted October 20, 2025

By Matt Insley

Rare Earth Risks

Posted October 17, 2025

By Matt Insley

The “Mamdani Effect” Could Be Hochul’s Undoing

Posted October 10, 2025

By Matt Insley

Paper Promises Fail, Real Assets Prevail

Posted October 08, 2025

By Matt Insley