Posted April 10, 2024

By Matt Insley

Crypto’s Addition By Subtraction

In less than two weeks, Bitcoin will enjoy a tailwind…

The next Bitcoin “halving” is scheduled sometime between April 18–22.

“A Bitcoin halving is a fundamental part of Bitcoin's economic model,” says Paradigm’s crypto expert (and James Altucher’s right-hand man) Chris Campbell.

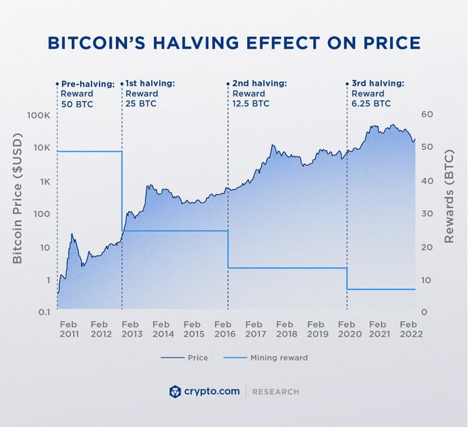

“During a halving,” he says, “the reward for mining new Bitcoin blocks is cut in half, effectively reducing the rate at which new Bitcoins are created and entering circulation.”

After former halvings in 2016 and 2020, Bitcoin rallied to all-time highs roughly 18 months later.

This time, in the immediate aftermath of the halvings, Chris and the Paradigm team believe “altcoins” — cryptos other than Bitcoin — will get more attention.

In short? “We’re looking at exciting months ahead for crypto.”

“The Trend Is Our Friend”

More on Bitcoin’s halving…

“For every 210,000 blocks [on Bitcoin’s blockchain], the number of newly issued Bitcoins is cut in half,” says Crypto.com.

“This translates to roughly every four years, depending on how quickly blocks are mined, which averages about [one] every 10 minutes.”

According to Chris, the next halving will occur when there are 840,000 blocks on Bitcoin’s blockchain.

He adds: “To get a clearer picture of where we are, let’s look at previous halvings…

“In 2012, the altcoin market didn’t exist, so there’s not much to say,” he says

“In 2016, the altcoin market — still in its infancy — experienced a relatively cool period following the halving, with prices remaining stagnant for around seven–eight months.

“The 2020 halving showed a similar picture. The altcoin market didn’t make big moves for months.

“As we approach the 2024 halving, the current altcoin cycle seems to be moving way ahead of both 2016 and 2020,” Chris observes.

“Increased mainstream attention and institutional investment in crypto have accelerated the market cap of altcoins to $1.15 trillion as of April 1, 2024.

“With a few impactful catalysts barreling down the pike in 2024, the trend is our friend…

“It will be CRUCIAL for investors to focus on altcoins with strong fundamentals, real-world utility and the ability to adapt to the evolving market conditions.

“We may see a consolidation phase where successful projects join forces or are acquired by established players,” he adds.

“We’re already seeing signs of this happening: Projects that can navigate the regulatory landscape and deliver value to users are more likely to succeed in the long run.”

Chris’ key takeaway: “As investors seek out higher-risk, higher-reward opportunities, altcoins are poised to benefit BIG from the increased attention and inflows. Especially as we inch toward more catalysts coming in 2024.

“In short, huge moves are coming,” he concludes.

Market Rundown for Wednesday, Apr. 10, 2024

The S&P 500 is down 1% to 5,155.

Oil is up 0.35% to $85.56 for a barrel of West Texas Intermediate.

The price of gold’s down about 1% to $2,330.70 per ounce.

Bitcoin’s pulled back 1.70% to $67,690 (which is normal in days leading up to the halving).

Send your comments and questions to, feedback@newsyoucanacton.com

Houthi Scholarships

Posted May 08, 2024

By Matt Insley

Basket Case

Posted May 06, 2024

By Matt Insley

Why Taxing Unrealized Gains is “Asinine”

Posted May 03, 2024

By Matt Insley

AI Frisks Baltimore High Schoolers

Posted May 01, 2024

By Matt Insley

Keys of the (Crypto) Kingdom

Posted April 29, 2024

By Matt Insley