Posted March 10, 2025

By Matt Insley

Don’t Panic

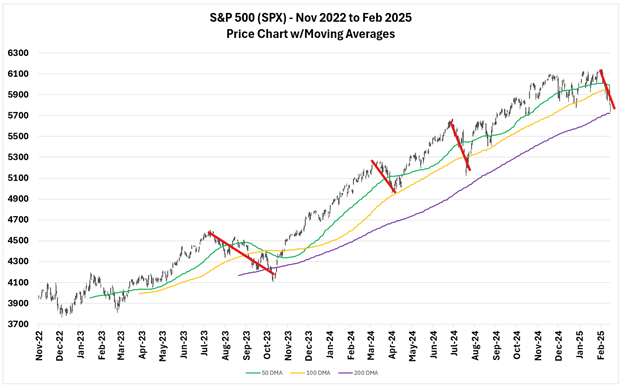

The recent market pullback has rattled investors, with the S&P 500 logging its worst day of the year last Monday, following its worst week just days earlier.

But let’s take a deep breath. Historically, dips like these in a bull market aren’t signals to panic — they’re opportunities to buy.

Let’s zoom out for perspective:

Since this bull market began, there have been several corrections of 5%–10%, including the current one.

While these pullbacks sting, they’re par for the course in a healthy bull run. In fact, such dips often pave the way for significant gains — if you play your cards right.

So how do you turn this dip into a win?

Your Rundown for Monday, March 10, 2025...

Pullbacks Don’t Have to Be Pitfalls

First, understand your portfolio’s position within the broader market trend.

During market highs, it’s wise to keep only 25%–50% of your TRADING portfolio invested.

When opportunities arise during selloffs, gradually increase exposure — up to 75% when the market approaches long-term averages like the 100-day moving average.

[Here are brief definitions of moving averages:

- 50-day MA: Average stock price over the past 50 days

- 100-day MA: Average price over 100 days

- 200-day MA: Average price over 200 days

These help track trends and market health.]

If the S&P 500 dips below its 100-day moving average, patience becomes key.

Start deploying capital incrementally: invest 5% halfway between the 100-day and 200-day averages, another 5% at the 200-day average, and keep reserves for deeper declines.

For every additional 5% drop in the index, allocate another slice of your portfolio. By the time the market is down 20%, you’ll be fully invested — but only if the bull market structure remains intact.

This strategy has proven effective time and again during bull markets.

However, it comes with a caveat: When key moving averages (like the 50-day and 100-day) fall below the 200-day average, it’s time to cut losses and reduce exposure by at least half.

Yes, this can hurt — but by then, your gains from earlier trades should outweigh any losses.

Ultimately, every investor must tailor their approach to their risk tolerance and goals.

But if you stick to these guidelines during market dips, you’ll position yourself for success in this ongoing bull run.

Market Rundown for Monday, March 10, 2025

S&P 500 futures are down 1.40% to 5,695.

Oil is up 0.55% to $67.40 for a barrel of WTI.

Gold is down 0.10% to $2,909.60 per ounce.

And Bitcoin is up 0.15% to $82,810.

Rickards: Mullahs and Midterms

Posted March 11, 2026

By Matt Insley

The 401(k)-Shaped Economy

Posted March 09, 2026

By Matt Insley

All For It, Dead Against It, Deeply Uneasy

Posted March 06, 2026

By Matt Insley

MTG vs. AOC

Posted March 04, 2026

By Matt Insley

The First 72 Hours: Ayatollah Is Dead

Posted March 02, 2026

By Matt Insley