Posted December 19, 2022

By Matt Insley

Elon Musk and “Vox Dei”

Elon Musk closed on his $44-billion Twitter acquisition on October 27, 2022. Since that time, it seems as if there’s a new Twitter controversy daily.

And the latest is a real tour de force, even by Musk’s standards…

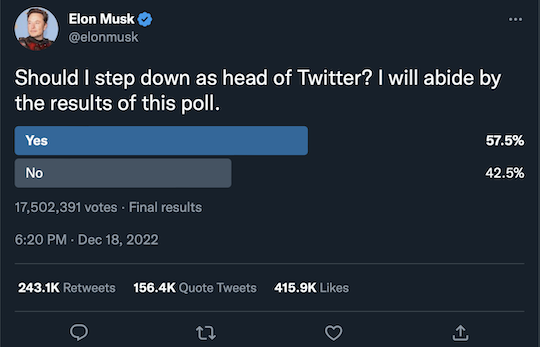

First, it’s extraordinary that more than 17.5 million people voted over the weekend. Second, it’s unclear whether Musk will actually step down, albeit the BBC notes: “In the past Mr. Musk has obeyed Twitter polls.”

Apparently, he’s partial to the Latin phrase “vox populi, vox dei.” Translation? “The voice of the people is the voice of God.”

It seems to me like Musk might be looking for an escape hatch, no? Paradigm’s science-and-technology authority Ray Blanco, at least, thinks Musk might be spreading himself too thin…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Monday, December 19, 2022...

Elon Musk Outpaces His Bandwidth

“Between Twitter, Tesla, SpaceX, Neuralink” — and other ventures — “Elon Musk is certainly a prolific figure in the tech world,” says Ray.

“Now, as the head of Twitter, Musk is focused on developing a digital ‘town square’ for people.” Allegedly. “However, this latest endeavor has occupied quite a bit of his attention… and Tesla Inc. (NASDAQ: TSLA) investors are starting to voice their concerns.

“Ironically enough,” Ray says, “much of that concern is being expressed on, well, Twitter.” For instance, managing partner Gary Black of The Future Fund LLC — which owns roughly $50 million worth of Tesla stock — tweeted this last week:

Regardless of what you think of Musk, there’s no denying he pulled off the improbable as “one of the few successful independent automakers and a pioneer in the electric car market…

“Since then, TSLA stock saw a meteoric rise that peaked during the pandemic-era bull market,” Ray says. “Now, TSLA is struggling to regain lost ground.

“Just take a look at the three-month chart:

Source: Technology Profits Daily

“Even before Elon took over at the social media company, TSLA was having a tough time,” says Ray. “To be fair, big tech has been locked in quite a tough trading environment, with the Nasdaq down around 28% so far.”

But at the time of writing, “TSLA is down over 60% this year,” Ray says. “If we don’t see some insane rally, the company is on the rails for its worst year in the market. By a wide margin.” For some context, the only year Tesla shares finished in the red — 2016 — TSLA was down about 10%.

“With a multitude of other auto manufacturers jumping into the EV race, [Musk’s] minor slip-ups could amount to lost market share as more options become available to consumers,” says Ray.

“Couple that with the fact that Elon bought Twitter with borrowed cash leveraged against his TSLA shares and you have a potentially dangerous situation brewing for the car company,” he concludes.

Market Rundown for Monday, Dec. 19, 2022

S&P 500 futures are nominally in the green at 3,880.

Oil is up almost 1% to $74.95 for a barrel of WTI.

Gold’s up $2.30 per ounce to $1,802.60.

And Bitcoin’s down 0.25% to $16,720.

Send your comments and questions to, feedback@newsyoucanacton.com

PROOF: Trump Was Right About the Economy

Posted March 07, 2025

By Matt Insley

Trump’s Crypto Curveball

Posted March 05, 2025

By Matt Insley

Germany and the Death of Globalism

Posted March 03, 2025

By Emily Clancy

Trump Effect Hits Germany

Posted February 28, 2025

By Emily Clancy

NVIDIA + TRUMP = 💥💥💥

Posted February 26, 2025

By Matt Insley