Posted June 18, 2024

By Matt Insley

Ethereum’s $154K Future

Before we begin today, a little housekeeping. There will be no market notes below as the U.S. stock market is closed in observance of Juneteenth.

Another quick reminder: On Monday, a reader said, “Chris Campbell, thanks for the info on the near future of silver.

“I have invested a bit (60–65 silver eagles) over the past couple of years, as well as about $2,500 in gold. I want to put more into the metals…maybe $5,000. Should I put it all in silver at this point?”

We return to a question a friend put to Chris Campbell back in 2012: I have $5,000… What should I buy and hold for the next 10 years?

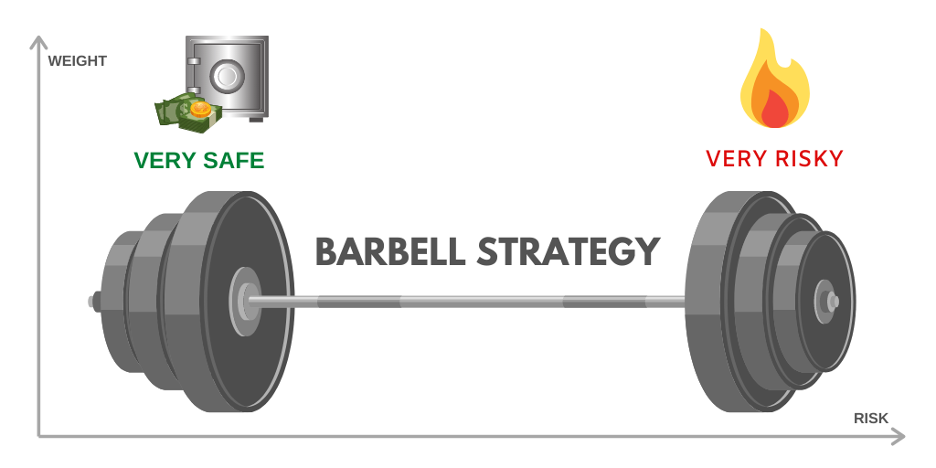

“He was looking for something fun, off the beaten path. Edgy,” Chris recounts. “I told him to get both silver and Bitcoin, a variation of the barbell strategy.”

Predictably, the friend didn’t listen to Chris (though we’re told he’s doing just fine).

Today, Chris Campbell — bleeding-edge crypto adopter and specialist — offers up another variation on the barbell strategy…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Wednesday, June 19, 2024...

A Bold ETH Prediction

“In a report titled ETH 2030 Price Target and Optimal Portfolio Allocations, VanEck outlined potential scenarios that have Ethereum's price eclipsing $150,000 per token by the end of this decade,” says Chris.

“Bold? Yes. BUT…

“The prediction reveals the supply and demand dynamics poised to supercharge Ethereum's value in the years ahead.

“Two years ago, Ethereum upgraded to a lesser-known deflationary burn mechanism which destroys ETH used for transaction fees.

“The more Ethereum is used, the more Ethereum is burned.

“Ethereum hasn’t really seen a raging bull market with this burn mechanism in place.

“Adding fuel to this potential fire: Since the recent approval of Ethereum ETFs on May 23rd, over $3 billion worth of ETH has been siphoned off centralized exchanges and into cold storage.

“This follows $500 million exiting exchanges in a single April week, leaving just 10.6% of the total circulating supply readily available on trading platforms –- the lowest levels in 6 years.

“When (not if) the ETFs soak up more of this dwindling supply, the stage is set for a buying frenzy exacerbated by Ethereum's burn mechanism,” Chris notes.

“That’s the case VanEck is making.

“They’re not the only ones…

“K33 Research forecasts up to 1 million ETH, worth over $4 billion at current prices, could be absorbed by U.S. ETFs upon launch. This would represent 1% of total supply.

“But that’s not all,” he continues. “Another compounding factor is the appeal of staking and ‘re-staking’ Ethereum for yield rewards.”

[For some background, back in 2022, Ethereum switched from a proof-of-work model to a proof-of-stake “mining” model.

“Part of ETH 2.0,” said Paradigm’s James Altucher at the time, “is that a validator of transactions risks losing its staked coins if it validates a fraudulent transaction.

“So some stakes will eventually get burned because of this.”]

“When coupled with demand from newly launched ETFs,” Chris adds, “Ethereum appears poised for a self-perpetuating supply shock cycle.

“Ethereum's scarcity tailwind strengthens further if the SEC ultimately permits ETFs to stake and earn yield, generating fresh incentives for accumulation by wealth managers.”

Chris’ takeaway? “While VanEck's $154K prediction seems outlandish today, Ethereum's confluence of dwindling supply, soaring institutional demand, and deflationary burn mechanics could…

“As they say in crypto…

Melt faces.

MISSING: 7 Million American Men

Posted October 21, 2024

By Matt Insley

Criminal Sex Changes and Kamala Harris

Posted October 18, 2024

By Matt Insley

Trump’s China Strategy vs. Biden-Harris

Posted October 16, 2024

By Matt Insley

The Myth of The “Undecided Voter”

Posted October 14, 2024

By Matt Insley

“Shared only amongst the elites…”

Posted October 11, 2024

By Matt Insley