Posted October 03, 2025

By Matt Insley

From Ben Franklin to Stablecoins

In the 1700s, Benjamin Franklin was contracted by the colonies of Delaware and Pennsylvania to print paper money, then known as scrip.

Franklin was a well known printer of books and a pillar of the business community. So printing money was a natural fit.

Ben invented fascinating currency security features, such as imprinting a real leaf onto printing plates. Due to its unique shape and veins, money with an imprinted leaf was very difficult to counterfeit. He also pioneered color-shifting inks.

Delaware and Pennsylvania’s scrip money was backed by tax revenues and land, not gold or silver. Britain wasn’t happy with its uppity colony, so had heavily restricted the flow of precious metals into the colonies to keep them dependent on the mother country.

Ben Franklin made sure that his scrip was difficult to counterfeit, and carefully controlled issuance to prevent inflation. His scrip money was wildly successful. A rare example of fiat currency that worked for the people.

Not every colony had such a diligent treasurer. Scrip money in many places was easy to counterfeit, heavily printed and rapidly became worthless.

Which brings us into the 21st century…

Tether — the world’s leading stablecoin which trades under ticker USDT on crypto exchanges — is a bit like modern scrip money.

As a stablecoin, USDT functions as a blockchain-based currency, pegged to the U.S. dollar and backed by revenue and hard assets.

Your Rundown for Friday, October 3, 2025...

Stablecoins: Modern Scrip Money

The goal of USDT is to always trade at $1. There are sophisticated mechanisms in place to ensure that it (almost) always stays there.

Tether is backed primarily by dollar-based assets such as U.S. bonds and bills. But over the past few years, Tether has made some interesting moves. They’ve added about 88,000 Bitcoin worth around $10 billion to their reserves.

Tether also owns 50 tons of gold and has invested in gold mining royalty stocks. The company even recently purchased 70% of Adecoagro, a South American agriculture firm which owns more than 210,000 hectares of farmland.

By diversifying into hard assets, Tether is looking to build a robust new form of money.

Tether is buying these assets to retain its spot as the largest stablecoin in the world. As long as investors are sure that Tether has the funds to back up their issued USDT, they are likely to retain that coveted top spot.

After all, stablecoins are an incredibly profitable business. Tether collects all the interest on the bonds and bills it owns, while paying out nothing to holders of USDT.

In Q2 2025, Tether reported $4.9 billion in profits on its stablecoin business. With just 100 employees, it is probably the most profitable business in the world on a per-employee basis.

For now, the U.S. is perfectly fine with their increased adoption, because a majority of the underlying funds are dollar-based assets, including American government bonds, bills and notes. Stablecoins are rapidly becoming one of the largest buyers of U.S. treasuries.

But what will happen if stablecoins begin to follow Tether’s lead and diversify into hard assets like gold and farmland?

With the rise of stablecoins, it’s a brave new monetary world out there. Ben Franklin, if he were still around, would undoubtedly be dabbling in this new monetary tech.

We’ll keep readers updated on this developing story.

Market Rundown for Friday, October 3, 2025

S&P 500 futures are nominally in the green at 6,770.

Oil’s up 0.50% to $60.80 for a barrel of WTI.

Likewise, gold is up 0.50% to $3,886.70 per ounce.

Bitcoin’s pulled back 0.50% to $120,200.

ROTFH: Rolling on the Floor Headless

Posted October 21, 2025

By Matt Insley

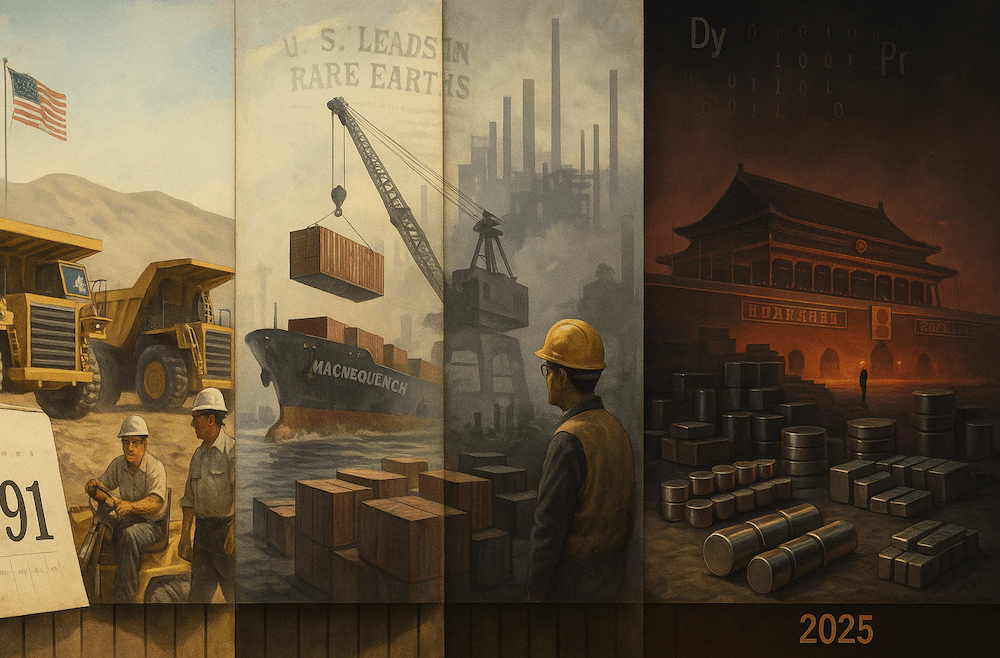

1991 → 2025: How China Won Resource Dominance

Posted October 20, 2025

By Matt Insley

Rare Earth Risks

Posted October 17, 2025

By Matt Insley

Jim Rickards: The Climate Cover-Up

Posted October 15, 2025

By Matt Insley

Censor First. Profit Later.

Posted October 13, 2025

By Matt Insley