Posted September 18, 2023

By Matt Insley

Goldman’s Ultra-Risky AI “Opportunities”

Happy Monday! Today, we’re giving the floor to Paradigm’s iconoclast investor James Altucher.

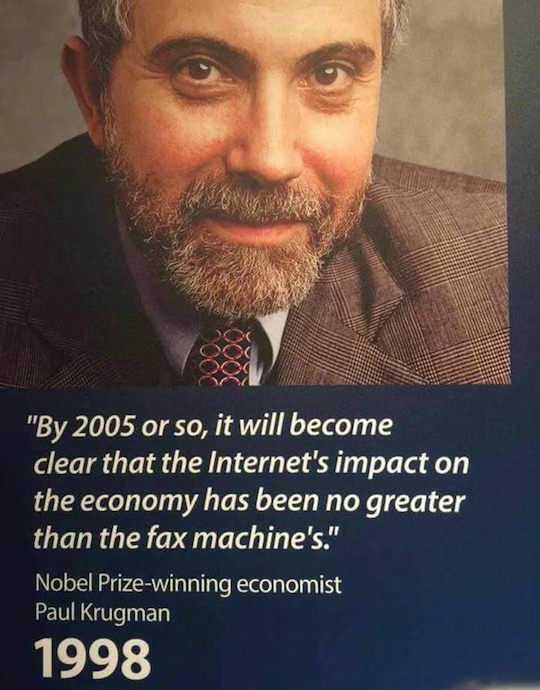

If you’re unfamiliar with James, he was an early adopter of the Internet — back when this hack was a naysayer…

More recently, James embraced crypto, becoming an expert on the subject (and making a fortune in the process).

Today? He comments on the tense standoff between two global superpowers… And artificial intelligence (AI).

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Monday, September 18, 2023...

New Cold War: The Next Front

“The U.S. and China have been in a ‘cold war’ for years,” James says. “Today’s battle du jour is AI supremacy.

“Knowing this,” he says, “Isn’t it odd that Goldman issued a couple of research notes to clients around the middle of this month, naming three Chinese stocks as opportunities (albeit not free from risk) in the AI space?

“The three companies Goldman highlights are Baidu, Alibaba and Tencent.

“My team and I are very familiar with these companies,” James continues. “We’ve followed them for years. And for the most part, they’re excellent companies.

“Unfortunately, here’s the problem…

“We live in a world where most Chinese-based companies are uninvestable due to the unpredictable nature of the Chinese government.

“Oh, and let’s not forget what we already know: The U.S. government is hellbent on restricting Chinese companies from accessing the chips necessary to make AI-based tech really hum.

“The bottom line is Goldman Sachs may believe Alibaba is cheap on a valuation basis and Tencent may be a rockstar in the world of advertising and payment recovery, but — I’ve seen this repeatedly over my career — until there is massive political reform in China, investing in its economy is very risky.

James concludes: “If someone convinces Tencent to sneak out of the country in the middle of the night and set up shop in a capital-friendly country…

“I’ll be the first investor through the door to reevaluate it.

“As always, we’ll continue to follow the story as it unfolds,” James adds. “Plus, we’ve uncovered a few opportunities that are way less risky.”

More on that in the weeks to come…

Market Rundown for Monday, Sept. 18, 2023

The S&P 500’s stalled at 4,450.

Oil is up 1.20% to $91.84 for a barrel of WTI.

Citing Kitco, Gold is up ever so slightly to $1,925.70 per ounce.

And Bitcoin is up 3% to $27,310.

Send your comments and questions to, feedback@newsyoucanacton.com

Jim Rickards: Before You Trust the Odds, Read This

Posted February 27, 2026

By Matt Insley

AI’s Y2K Moment

Posted February 25, 2026

By Matt Insley

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley