Posted January 30, 2026

By Matt Insley

How Congress Gets Rich

[Matt Insley here: This week, Ilhan Omar is back in the headlines after a man rushed a Jan. 27 town hall in Minneapolis and sprayed her with apple cider vinegar (allegedly) before being arrested. Omar was unharmed and finished the event — but the scrutiny around her isn’t slowing down.

Which makes today’s feature especially timely.

The Rundown is pleased to welcome Emily Clancy, who’s spent almost nine years helping shape Paradigm Pressroom’s 5 Bullets, pursuing the stories much of the media overlooks.

Today’s piece is longer than usual — so no market notes… But it’s well worth it.]

On Jan. 22, 2026, Rep. Kevin Hern (OK-R) filed paperwork revealing he’d sold up to $500,000 of UnitedHealth stock. Three days later, UNH crashed 20% after the Trump administration proposed slashing Medicare Advantage payment rates.

The timing was, as one headline put it, “super suspicious.” The transaction date? Dec. 23, 2025 — a month before the disclosure, meaning Hern actually missed the January rally. Still, the optics were bad enough to make news.

Tracking congressional stock trading has now become one of America’s least favorite pastimes. Every filing brings a fresh round of questions.

While much of the attention focuses on stocks and suspicious timing, in the case of Rep. Ilhan Omar (MN-D), an equally interesting story lies in the sprawling ecosystem of LLCs, venture capital and business valuations that populate these financial forms.

Particularly when valuations balloon overnight.

The Curious Case of Rose Lake Capital

In May 2025, Rep. Ilhan Omar filed her annual financial disclosure for 2024. Among the listed assets: Rose Lake Capital LLC, valued between $5 million and $25 million.

This represented a dramatic increase from the previous year's filing, which listed the same company between $1 and $1,000.

Congressional disclosure forms report assets in ranges rather than exact figures, but even using the most conservative math — $5 million compared to $1,000 — that's a 500,000% increase in a single year.

Rose Lake Capital is co-owned by Omar’s husband, Tim Mynett, and his longtime business partner Will Hailer. The firm’s website describes it as focused on “unique global opportunities… in more than 80 countries working across business, politics, banking and diplomacy.”

The site once listed an impressive roster of employees, including a former ambassador to Bahrain. But as scrutiny intensified in late 2024 and 2025, the company scrubbed its website of team members’ names and biographies.

Here’s where the numbers get interesting. In June 2024, court filings claimed Rose Lake Capital had a bank balance of $42.44. Six months later, the same firm would be valued up to $25 million on Omar’s disclosure form.

The Phantom Winery

The second major asset on Omar’s disclosure is eStCru LLC, a California winery. Its reported valuation: $1–5 million in 2024, up from $15,000–50,000 the previous year.

According to reporting by the Minnesota Reformer and Rhode Island Current, the winery has a truly bizarre origin story.

Mynett and Hailer had been paid in grapes by a former political consulting client (more on that in a moment). The business partners hired a Sonoma winemaker and sought investors for a wine venture.

In fall 2021, D.C. restaurant owner Naeem Mohd was approached with what seemed like an incredible opportunity. Invest $300,000, the pitch went, and receive $900,000 back in just 18 months — a 200% return. If payment was late, 10% monthly interest would accrue.

Mohd was advised by attorney Faisal Gill, himself a Democratic political operative who previously worked with Mynett on campaigns for Minnesota’s Attorney General Keith Ellison. On Gill’s advice, Mohd wired the funds.

“I trusted Tim,” Gill told the Rhode Island Current. “If it was not for Tim, the deal would have never happened.”

Eighteen months came and went. Mohd eventually received his $300,000 principal back — about a month late — but no profits, no interest. He filed a lawsuit in California seeking at least $780,000, claiming the pair “fraudulently misrepresented… that eStCru LLC was a legitimate company.”

Mynett and Hailer denied wrongdoing. Hailer blamed pandemic woes, telling the Minnesota Reformer: “EStCru LLC like many wineries is living invoice to invoice, sale to sale to stay afloat given the economic conditions of the industry.”

Yet somehow, between 2023 and 2024, this invoice-to-invoice operation apparently increased in value by at least 20-fold, depending on which ends of the disclosure range you use.

Today, the winery’s website shows no functioning purchase portal. Its last social media post dates to January 2023. The listed phone number doesn’t work. The intellectual property is reportedly for sale.

Your Rundown for Friday, Jan.30, 2026...

A Sordid Pattern Emerges

Before Rose Lake Capital and eStCru winery, there was the E Street Group — a political consulting firm Mynett co-founded with Hailer in 2018. The firm’s website consisted of a single landing page and accepted new clients only by referral.

During the 2019–2020 election cycle, Ilhan Omar’s congressional campaign paid E Street Group $2.78 million, making the firm the campaign’s second-largest recipient of funds, behind only the Minnesota Democratic Party.

The spending was legal. But it drew scrutiny because of who was being paid, how much and when.

In August 2019 — while the payments were ongoing — Mynett’s then-wife filed for divorce, alleging that he was having an affair with Omar. Both denied the allegation, but they married in March 2020, shortly after finalizing their divorces.

The Federal Election Commission (FEC) — the independent agency that enforces U.S. campaign-finance law — reviewed complaints alleging the payments improperly mixed campaign and personal expenses. The agency ultimately found no legal violations.

After the 2020 election, Omar severed all campaign ties with the E Street Group. Even so, the episode left lingering questions about optics and Omar’s judgment.

The Marriage Plot

Tim Mynett is Omar’s third legal husband. But her marital history has been the subject of extensive reporting and investigation, though many key facts remain disputed or unproven.

- In 2002, Omar religiously married Ahmed Abdisalan Hirsi (not legally). They had two children but separated in 2008 and obtained a religious divorce

- In 2009, she legally married Ahmed Nur Said Elmi, a British citizen. They separated in 2011

- Omar reunited with Hirsi in 2012 and had a third child

- She divorced Elmi in 2017, then legally married Hirsi in 2018

- She filed for divorce from Hirsi in 2019 and married Mynett in 2020.

The most explosive allegation — that Omar married Elmi, who some claim is her brother, to commit immigration fraud — has been investigated by multiple outlets. None found rock-solid proof.

The Minneapolis Star-Tribune, Omar’s hometown newspaper, spent months investigating, ultimately reporting it “could neither conclusively confirm nor rebut the allegation.”

Much of the evidence was sourced from social media posts that were subsequently deleted. Screen grabs exist, but verification has proven impossible. Plus, Somalia — Omar’s birthplace — had limited government record-keeping during the civil war era, making definitive proof elusive in either direction.

What is documented…

In 2019, Minnesota’s Campaign Finance and Public Disclosure Board found that Omar filed joint tax returns in 2014 and 2015 with Hirsi — while she was legally married to Elmi — a violation that resulted in a reimbursement around $3,500 to her campaign committee, plus a $500 penalty.

The Minneapolis Context

Allegations against Omar don’t exist in a vacuum. Minnesota — and Minneapolis specifically — has been rocked by revelations of massive fraud recently, especially involving state and federal programs.

The “Feeding Our Future” scandal, centered in Minneapolis’ Somali community, allegedly defrauded federal child nutrition programs of approximately $250 million during the COVID-19 pandemic. Federal prosecutors have described it as one of the largest pandemic fraud schemes in the nation.

Though Omar did sponsor the MEALS Act of 2020, which temporarily eased oversight rules on school meal programs, there’s no evidence Omar knew of or profited from the subsequent fraud.

FBI Director Kash Patel has called the $250 million child nutrition fraud “the tip of the iceberg.” State and federal authorities estimate potential losses across various Minnesota fraud schemes could exceed $9 billion. Much of this involves child care assistance fraud, Medicaid fraud and pandemic relief fraud.

Omar has faced criticism for her response — or lack thereof — to the fraud revelations, particularly given that much of it occurred in her district.

Her defenders note she’s not accused of any connection to these schemes. Her critics argue that as the representative for the affected communities, she should be demanding accountability.

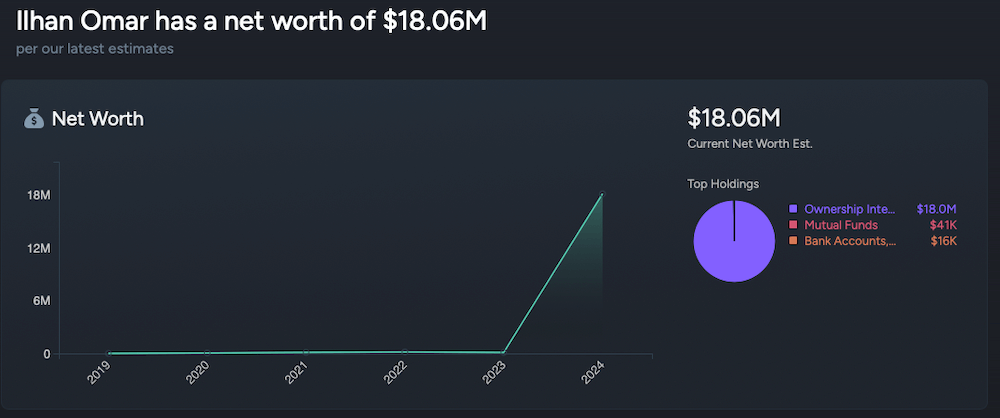

The Net Worth Debate

This month, President Trump claimed on Truth Social that federal investigators were “looking at” Omar’s finances, suggesting her net worth had reached $30–44 million. The number spread quickly — and, in all likelihood, inaccurately.

That rough figure comes from adding the maximum disclosed values of the two businesses tied to her husband: Rose Lake Capital (up to $25 million) and eStCru winery (up to $5 million).

When Omar entered Congress in 2019, it should be noted, she reported a negative net worth, largely due to student loans and other debts.

Today? Quiver Quantitative, which aggregates congressional disclosures, places Omar’s net worth over $18 million. That figure isn’t definitive, but it highlights the real issue — the public is left guessing.

Courtesy: Quiver Quantitative

Omar’s office says her husband, Tim Mynett, is one of several partners in his business ventures, meaning his actual stake could be far smaller than the headline valuations suggest. But the disclosures don’t say how much he owns. No percentages. No clarity.

That omission isn’t illegal.

But other members of Congress, including Reps. Cory Mills and Suzan DelBene, routinely disclose exact ownership stakes in closely held businesses. Omar does not. The result is a filing that complies with the letter of the law while frustrating its supposed purpose: transparency.

At the same time, Omar’s congressional salary — $174,000 a year — does not explain the appearance of eight-figure household wealth on its own.

That gap isn’t proof of wrongdoing. But it does warrant explanation.

The Accountability Question

Lawmakers are allowed to trade stocks. They’re allowed to hold private businesses. And they’re allowed to report those interests in vague ranges and move on.

If they get caught late filing, they pay a fine smaller than some dinner receipts and keep going. That’s not a real deterrent.

Kevin Hern’s UnitedHealth trade wasn’t transparent. It came to light because the STOCK Act (2012) forced disclosure — weeks later and after the trade was already done.

Ilhan Omar’s disclosures present a different problem. Not necessarily suspicious timing, but suspicious opacity. Companies that appear dormant on paper suddenly carry multimillion-dollar valuations. Ownership stakes aren’t specified. Numbers jump, but explanations don’t follow.

The public is left squinting at paperwork that technically complies with the rules while failing to answer the obvious questions.

Congress, meanwhile, likes to tell itself that disclosure equals accountability. It doesn’t. Disclosure without enforcement is theater.

The paper trail is there. What’s missing is a system that insists on straight answers — and hard consequences.

Three Commodity Calls. All Profitable.

Posted January 28, 2026

By Matt Insley

Trump Puts Allies on Notice

Posted January 26, 2026

By Matt Insley

The Great SaaS Meltdown

Posted January 23, 2026

By Matt Insley

Greenland, Inc.

Posted January 21, 2026

By Matt Insley

Texas-to-California Pipeline Moves Forward

Posted January 19, 2026

By Matt Insley