Posted September 15, 2025

By Matt Insley

Jim Rickards: Lower Rates Are Coming

The Federal Reserve was born in secrecy. In 1910, a handful of powerful bankers and politicians gathered in Jekyll Island, Georgia, to design a central bank shrouded in mystery.

More than a century later, Paradigm’s macro expert Jim Rickards says the Fed has achieved one of those goals: mystery. Power? Not so much.

“The Federal Reserve is irrelevant unless it’s doing damage to the economy,” Jim says. “And because it’s usually doing damage, it deserves our attention.”

At first glance, that seems outrageous. The Fed dominates headlines. Every Fed meeting is treated like a papal conclave. Markets hang on every word of its governors.

But Jim insists the image is a mirage: the Fed wants you to believe it’s omnipotent, yet once you pull back the curtain, it’s fumbling in the dark.

Your Rundown for Monday, September 15, 2025...

The Fed Follows, Never Leads

Jim has seen the Fed’s inner workings first hand “I spent ten years as chief counsel and chief credit officer of a primary dealer. We spoke to the Fed daily. I had a front-row seat.”

Here’s how the magic trick works: The Fed creates dollars out of thin air by buying Treasury securities from select banks. “But since 2008, those dollars just sit on deposit at the Fed as excess reserves,” Jim explains. “The banks don’t lend them, they don’t invest them… It’s all a mirage.”

The real money creation — the kind that funds businesses, mortgages, credit cards — happens at commercial banks, not the Fed. And those banks are pulling back.

Consumer credit losses are piling up, mortgage lending is slowing and businesses don’t want to borrow. When banks don’t lend, Jim warns, you have the makings of a recession. So-called Fed stimulus won’t change that.

The Fed’s vaunted policy rate is another illusion. “The market the Fed targets hasn’t existed since 2008,” Jim says flatly. While the Fed tinkers with a phantom fed funds rate, real markets — U.S. Treasuries, the repo market — are already setting lower rates on their own.

“The Fed isn’t leading the market,” says Jim. “They’re following it.”

That’s why Trump’s demands for lower rates are misguided.

He’ll get the low rates he wants, Jim notes, but not from the Fed. He’ll get them from a recession. By the time rates hit 2%, Jim believes, unemployment will be rising and the stock market will be falling out of bed. That’s not the outcome Trump had in mind.

Why does the Fed keep getting it wrong? Because it believes in models that don’t work.

Chief among them is the Phillips Curve, which claims unemployment and inflation move in opposite directions. “It’s nonsense,” Jim scoffs. “We’ve had times of high unemployment and high inflation, and times of low unemployment and low inflation. The curve doesn’t exist.

“Still, the Fed believes in it, which is why they have not cut rates for almost a year. The Fed is worried about inflation even as unemployment is on the rise. This high-rate policy will just make the unemployment situation worse.”

The same goes for their belief that long-term rates are just a chain of short-term rates rolled forward. “That’s another fiction,” Jim says. “Long-term rates are set by market forces — liquidity, hedging, portfolio flows — not by the Fed’s imaginary ‘term premium.’ It’s a story they tell themselves to justify their relevance.”

Much has been made of “threats to Fed independence” under Trump. Jim dismisses the concern. “Fed independence never really existed,” he says.

From Treasury dictating rates during World War II, to Lyndon Johnson physically assaulting the Fed chair over hikes, to Nixon pressuring Arthur Burns before the 1972 election, history shows the Fed has always bent to politics. “To single out Trump as a unique threat is historically false,” Jim says.

Even today, Trump’s moves to reshape the Fed board are headline fodder. His attempted removal of Fed Governor Lisa Cook, tied to alleged mortgage fraud that’s now under investigation, is the latest example of political turbulence.

But Jim argues it won’t matter. In the end, interest rates are coming down for reasons bigger than the Fed and beyond its control.

So where does this leave us? Jim summarizes: “The Fed is irrelevant. When it tries to act, it damages the economy. When it stays put, markets do the heavy lifting. Either way, the Fed is not in charge.”

That’s the reality behind the curtain first drawn on Jekyll Island: a central bank built on secrecy, cloaked in power, but unable to deliver on its own mythology.

“The Fed cannot stop inflation,” Jim concludes. “It cannot prevent recessions. It cannot even control interest rates. The Fed is not the master of the economy. It’s the stumbling block.”

Market Rundown for Monday, September 15, 2025

S&P 500 futures are up 0.25% to 6,660.

Oil is up 0.45%, just under $63 for a barrel of WTI.

Gold’s lost about 0.30% to $3,674.30 per ounce.

Bitcoin, at the time of writing, is down 0.65%, and just under $115K.

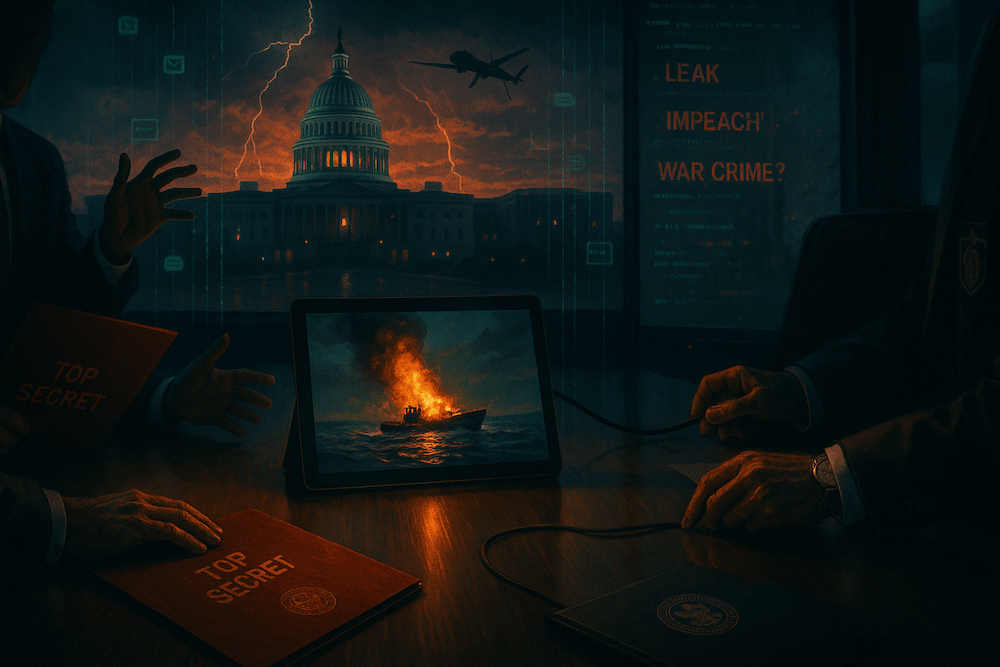

Department of War (Crimes)

Posted December 05, 2025

By Matt Insley

Americans Are Drowning All Around Us

Posted December 03, 2025

By Matt Insley

Trump Rewrites Ukraine’s Peace Plan

Posted December 01, 2025

By Matt Insley

Nvidia’s Uncertain Future

Posted November 26, 2025

By Matt Insley

Dead Men Can’t Trade

Posted November 24, 2025

By Matt Insley