Posted December 30, 2020

By Byron King

MMT and QE (A Wing and A Prayer)

Doling out $2000/person -- or $4000 for a married couple -- is a lot of money! says our first contributor regarding Trump and Democrats stimulus proposal. And many folks who don't really need the money will get it anyway yikes!

Its good for precious metals, Bitcoin and the wealthiest among us though but stimulus payments are going to make things worse when the next crisis arrives (and it surely will arrive). Good thing we have the world's reserve currency to keep the music playing for a spell.

Modern Monetary Theory (MMT) is alive and well, folks, and we get a front-row seat for just how long this wrongheaded economic theory can last.

Another reader must have gotten the memo that the U.S. Senate rejected $2,000 checks

I dont side with Republicans, Democrats OR Trump! he says. What a joke: $600 after all these months? Yet members of Congress and senators collect their *undeserved* paychecks?

Perhaps they should forgo their paychecks; let them live on scraps for a while and see how they like it. Theyve done nothing more than bicker and betray the American people, in my opinion.

As we close out the year, just a quick thank you for writing in! The Rundown appreciates your opinions -- you keep the discussion lively, relevant and provocative.

Send your opinions to, TheRundownFeedback@SevenFigurePublishing.com.

Your Rundown for Wednesday, Dec. 30, 2020

QE on A Wing and A Prayer

At its December meeting, the Federal Reserve signalled interest rates will remain near 0% through 2023 at the very least. The Fed also indicated it would continue its bond-buying spree -- one of the mechanisms of quantitative easing (QE).

The effect of QE is to increase the money supply while driving down long-term interest rates, says Mark Grywacheski of Quad-Cities Investment Group.

The Fed hopes that flooding the economy with cash, combined with lowering long-term interest rates, will artificially create demand for goods and services, thus stimulating economic growth.

It all hinges on a wing and a prayer really Something Libertarian OG Ron Paul voiced his concern about in September 2019.

CNBC said: According to Paul, central banks which drastically lower interest rates destroy the pricing mechanism in financial markets.

Paul told CNBCs Future Now: We will go to total negative rates in hopes that that will be the solution.

Every time you lower interest rates below market levels and create new credit, thats a bubble, he said. We have the biggest bubble in the history of mankind.

As for the timing of the bubbles burst, Paul said: You dont know the precise time. But you know it can happen.

Add a pandemic to the mix -- something Mr. Paul couldnt have foreseen at the time -- front-row seat to the collapse of MMT indeed.

Market Rundown for Wednesday, Dec. 30, 2020

S&P 500 is up 14 points to 3,740.

Oils up 30 cents to $48.30 for a barrel of West Texas crude.

Gold is up $6.40 to $1,889.30 per ounce.

Bitcoins up another 1.5% to $28,163.25.

Send your comments and questions to, TheRundownFeedback@SevenFigurePublishing.com.

Were taking off New Years Day. Cheers to you and yours! Well be back next year

For the Rundown,

Aaron Gentzler

Nvidia Haters Are Seething

Posted January 09, 2026

By Matt Insley

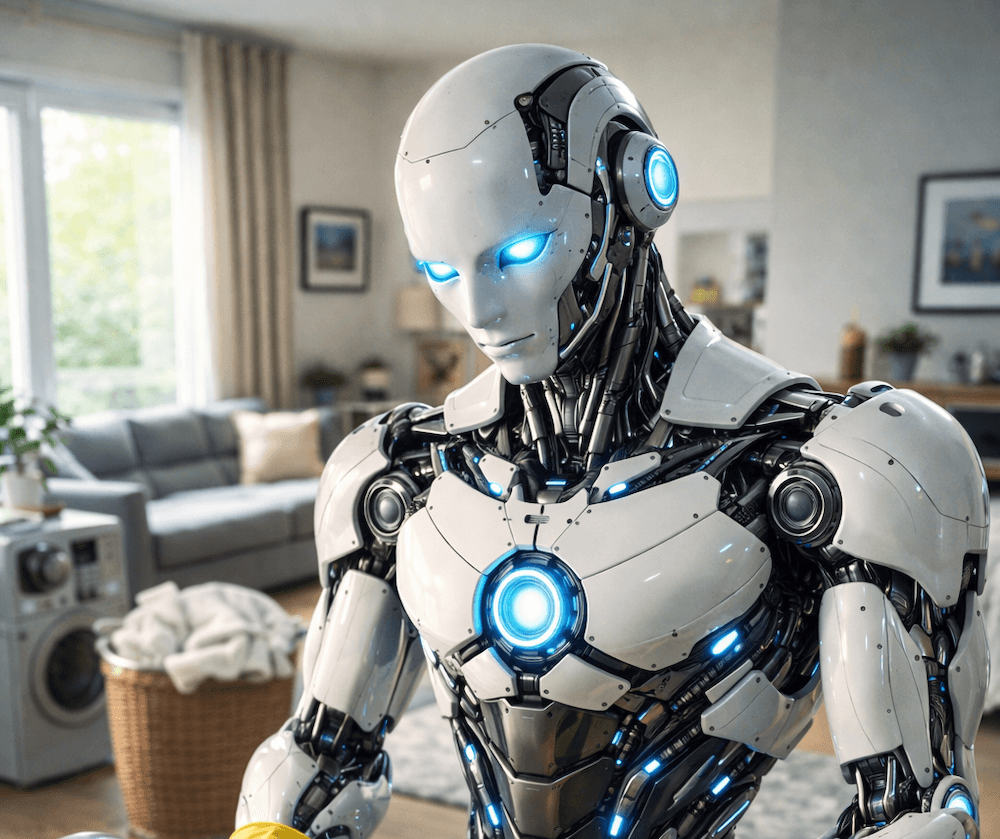

Okay, I Get Why Robots Have Two Legs

Posted January 07, 2026

By Matt Insley

Buck Sexton on Venezuela

Posted January 05, 2026

By Matt Insley

Socialism Has Arrived in NYC

Posted January 02, 2026

By Matt Insley

Trump's 2025 Report Card - Honest Grades

Posted December 22, 2025

By Matt Insley