Posted October 08, 2025

By Matt Insley

Paper Promises Fail, Real Assets Prevail

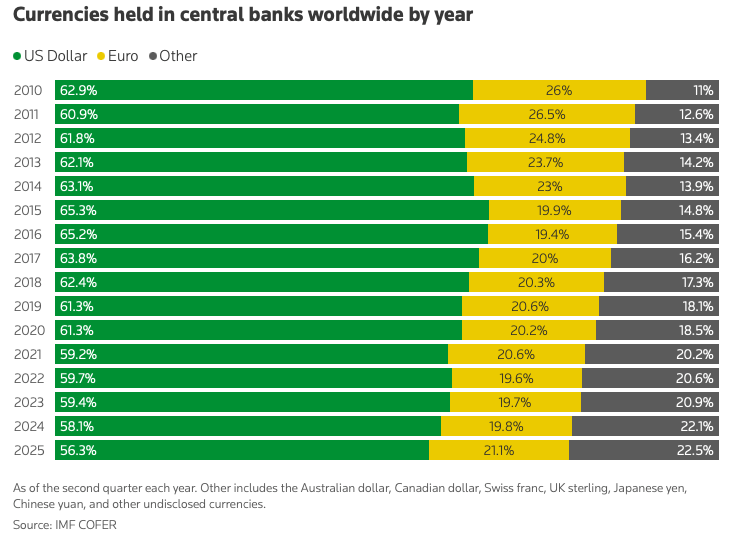

Buried in an International Monetary Fund (IMF) data release last week was a number that should stop Washington in its tracks:

The U.S. dollar’s share of global currency reserves just slipped again — down to 56.32%. It’s the lowest level in 30 years.

In other words, the rest of the world seems to be quietly diversifying away from the U.S. dollar.

Your Rundown for Wednesday, October 8, 2025...

The Long Shadow of 1971

But the IMF also added some crucial context: “92% of the dollar’s drop is explained by exchange-rate effects.”

Meaning, most of this decline wasn’t because other countries actually sold their dollars. It’s more like math at work.

- The IMF totals up all the currencies held by central banks — dollars, euros, yen and so on — and then converts everything into U.S. dollars to make its report.

- So, if the dollar gets weaker (more on that in a moment), the value of those other currencies automatically looks larger when measured in dollars. Even if nobody moves a dime, the dollar’s “slice” of the global reserve pie looks smaller.

Still, small accounting shifts can turn into real shifts over time. Because once investors see that chart slipping — even by a fraction — they start asking whether it’s time to diversify for real.

The irony is that the dollar’s real vulnerability traces back more than fifty years — to August 15, 1971, when President Richard Nixon unpegged the U.S. dollar from gold.

Overnight, America moved from a currency backed by a tangible asset to one backed only by confidence and credit. And the dollar became what Paradigm’s macro expert Jim Rickards calls “the world’s greatest faith-based currency.”

Once you remove gold — or any real anchor — the only thing holding the system together is trust. And faith, as the IMF data quietly shows, can weaken little by little.

For years, Jim’s warned this would happen. His American Birthright thesis argues that the U.S. can’t preserve monetary dominance while outsourcing production and piling up debt.

A strong currency, he says, isn’t sustained by slogans or sanctions, but by real assets — land, natural resources, energy and more.

The IMF data shows how far we’ve drifted from that foundation. The dollar index has fallen more than 10% this year — its sharpest drop since 1973.

Some will blame Trump, but the deeper issues predate him by decades: America hollowed out its industrial base, replaced production with paper wealth and let Wall Street’s leverage become the economy’s backbone.

That’s the dollar’s real vulnerability Jim has been pointing to all along.

If there’s a silver lining, it’s that this wake-up call could push America to rediscover its strength, the tangible kind. The American Birthright isn’t nostalgia; it’s strategy. Rebuild domestic industry, secure energy independence and make the dollar as strong in substance as it is in symbol.

Because when the world begins to cash out of America’s paper promises, the only thing left to stand on is what’s tangible — and what’s truly ours.

Market Rundown for Wednesday, October 8, 2025

S&P 500 futures are up 0.15% to 6,770.

Oil is up 1.45% to $62.60 for a barrel of WTI.

Gold’s up 1.45% to $4,061.50 per ounce.

And Bitcoin is up 0.75% to $122,500.

ROTFH: Rolling on the Floor Headless

Posted October 21, 2025

By Matt Insley

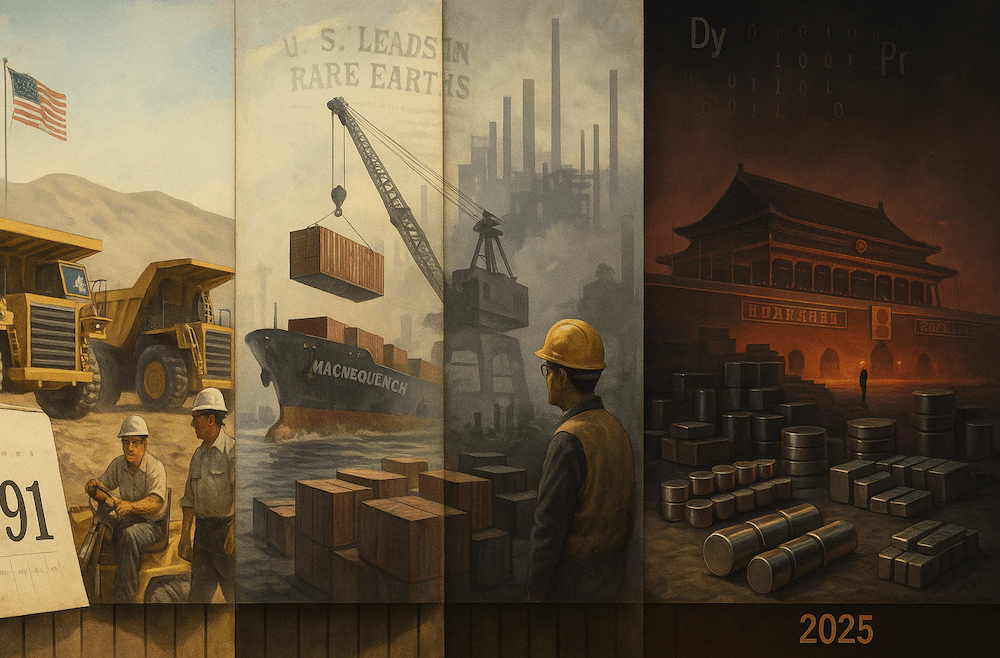

1991 → 2025: How China Won Resource Dominance

Posted October 20, 2025

By Matt Insley

Rare Earth Risks

Posted October 17, 2025

By Matt Insley

Jim Rickards: The Climate Cover-Up

Posted October 15, 2025

By Matt Insley

Censor First. Profit Later.

Posted October 13, 2025

By Matt Insley