Posted July 25, 2025

By Matt Insley

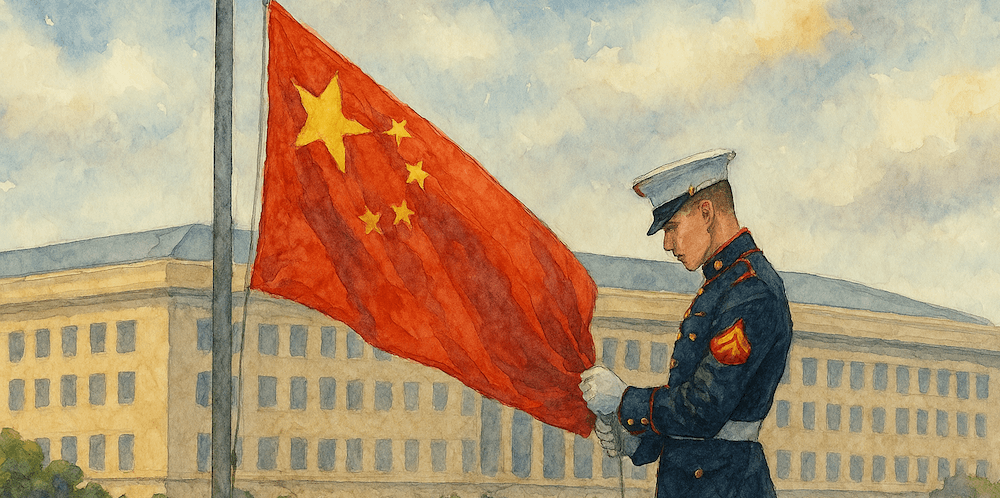

Pentagon to China: No More Bowing to Beijing

Did you know that more than 78% of U.S. military weapons rely on materials that come from China?

From the F-35 fighter jet to submarines and satellites, critical minerals like tungsten, gallium and rare earths make our defense systems tick.

These aren’t optional extras — they are the building blocks of American military power and the future of our economy.

Without a secure, local supply, we’re fighting with one arm tied behind our back. But the Department of Defense (DOD) is loosening that tie.

In their own words: “Rebuilding the critical minerals and rare earth magnet sectors of the U.S. industrial base won’t happen overnight, but (the Pentagon) is taking immediate action to streamline processes and identify opportunities to strengthen critical minerals production.”

That’s a big deal. And it’s not just talk.

Your Rundown for Friday, July 25, 2025...

China’s Latest Power Play

Just last week, the Pentagon committed a multibillion-dollar investment to become the largest shareholder in MP Materials (MP), America’s top rare earths producer. But this isn’t just about one company.

The DOD has already invested almost $540 million into various critical minerals projects and confirms they will redouble their efforts.

This approach includes leveraging the Defense Production Act (DPA) of 1950, a law originally passed at the start of the Korean War, to address urgent national security needs tied to critical minerals and manufacturing capacity.

The goal? To break free from Chinese control of the mineral supply chain and build genuine American capacity, not just for business, but for our national survival.

Let’s get real: China controls about 90% of the world’s supply of refined rare earths and dominates the market for other key minerals like gallium, antimony and germanium, essential for everything from guided missiles to stealth jets.

Earlier this year, Beijing imposed sweeping new export restrictions on seven critical rare earth elements (including samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium) — the exact materials vital for U.S. military tech.

It doesn’t stop there. China recently banned or restricted exports of at least a dozen other minerals and alloys, directly threatening Western security interests and supply chains.

But the Pentagon’s gutsy moves reinforce this message: America is done with dependency and backfoot strategies.

And Paradigm’s macro authority Jim Rickards knows what’s at stake — nothing short of America’s sovereignty, security and prosperity.

Market Rundown for Friday, July 25, 2025

S&P 500 futures are up 0.10% to 6,400.

Oil is up 0.50% to $66.38 for a barrel of West Texas crude.

Gold’s down 0.90% to $3,342.70 per ounce.

And Bitcoin’s down 2.60% to $116,000.

Trump's 2025 Report Card - Honest Grades

Posted December 22, 2025

By Matt Insley

Jim Rickards: How America Falls

Posted December 19, 2025

By Matt Insley

2026, Uncovered

Posted December 17, 2025

By Matt Insley

I ❤️ Silver

Posted December 15, 2025

By Matt Insley

A Silver Bug Moment

Posted December 12, 2025

By Matt Insley