Posted August 07, 2024

By Matt Insley

Recession = Trump Landslide Win

Here’s where we left you Monday…

Stocks were experiencing a face-melting slide during pre-market hours.

The round numbers?

DJIA down 1,000 points. The Nasdaq and S&P 500 down 5% and 4% respectively.

At which point, we planted a flag: The Fed should make an emergency rate cut of 50 bps. Now.

We weren’t alone…

Moments after we published, Wharton professor Jeremy Siegel put the Fed on blast, calling for an emergency rate cut of 75 bps.

We find the Fed has only done something similar — made an unscheduled rate cut — about a dozen times in its 110-year history.

Including: October 1987… October 1998… 2001… 2007-2008… and March 2020.

If you’re keeping score, the Fed made surprise cuts, usually to the tune of 50 bps, (1) to short circuit inflation/hyperinflation or (2) in response to Black Swan events, including 9/11 and a global pandemic.

(But, let’s be real, these emergency cuts mainly backstop the stock market.)

This morning, the likelihood of an emergency rate cut is much lower than it was Monday.

But we’re not taking it off the table either…

As Paradigm’s macro expert Jim Rickards said in May:

“If the Fed cuts rates,” — before achieving its 2% inflation target — “it’ll be for very bad reasons. It’ll be because we’re in a recession that’s undeniable, that’s getting more severe, that’s going to take the stock market down.”

It’s that “r” word — recession — that’s top of mind for investors today.

And voters…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Wednesday, August 7, 2024...

If We Have a Recession, the Election Won’t Be Close...

Other than Main Street investors hoping to retire someday, the person with the most to lose Monday was… Kamala Harris.

What James Carville told Bill Clinton in 1992 holds true today: It’s the economy, stupid.

When the specter of a recession looms large, voters generally run for the exits, far away from the incumbent party.

Nonetheless, Vice President Harris maintains: “Bidenomics is working.”

One simple question, however, obliterates that myth.

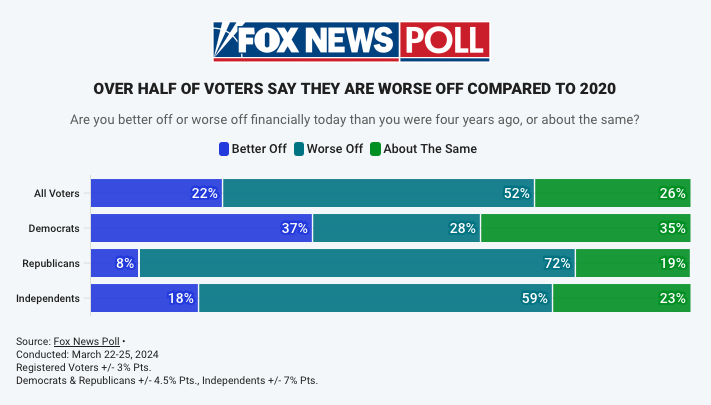

“Are you better off than you were four years ago?” Reagan asked voters in 1980.

Today, the answer is clearly no…

That’s a snapshot of how everyday Americans perceive their personal economies — having to put food on the table, a roof over their heads, gas in the tank.

“Whatever stories Americans are told about the strength of the economy under President Joe Biden,” says economist James Galbraith…

… they are not going to be persuaded to look past the issue of their own living standards.

Word.

As the dream of the Fed engineering a “soft landing” for the U.S. economy disappears…

So too do Kamala Harris’ presidential prospects.

And her choice of a running mate yesterday might have sealed her fate.

We’ll leave it there for now, reader. But check back Friday for more on Minnesota Gov. Tim Walz.

Market Rundown for Wednesday, Aug. 7, 2024

S&P 500 futures up 1.10% to 5,325.

Oil futures are up 2.40% to $74.95 for a barrel of WTI.

Gold futures are up 0.35% to $2,440.90 per ounce.

Bitcoin is up 0.60% to $57,100.

Send your comments and questions to, feedback@newsyoucanacton.com

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley

The Ring Cam’s AI Surveillance

Posted February 11, 2026

By Matt Insley

Make Shame Great Again

Posted February 09, 2026

By Matt Insley

SAAS STOCKS CRASH

Posted February 06, 2026

By Matt Insley

CA’s New Surveillance Tax

Posted February 04, 2026

By Matt Insley