Posted August 04, 2021

By Aaron Gentzler

Resignation or Impeachment?

As we said almost five months ago now, Gov. Cuomo’s sexual harassment scandal -- sickening as it was -- took a backseat to the scope of the governor and his aides rewriting data about Covid-related nursing home deaths in New York.

To us anyway…

Recall at the time, however, some Democrats urged caution when it came to dispensing with the scandal-plagued governor, all in the name of political power.

The message? The lives of senior Americans -- along with the safety and dignity of several young women -- were expendable. So long as a Dem stayed in office.

(And just so we’re clear, both parties are guilty of political expediency. No one has the moral high ground.)

Now in the last 24 hours, the narrative is shifting. The speaker of the New York Assembly, Carl Heastie (D), says Cuomo’s impeachment inquiry should be wrapped up “as quickly as possible.”

And the president’s weighing in too. “I think he should resign,” Biden says.

Either way, it seems Cuomo will be moving out of the Governor’s mansion…

Send your opinions to, TheRundownFeedback@StPaulResearch.com

Your Rundown for Wednesday, August 4, 2021...

Industrial Sector Gears Up for Growth

“The industrial sector looks poised for big gains,” says our retirement specialist Zach Scheidt.

“After a strong run earlier in the year, stocks in this group have been consolidating. Meanwhile, earnings are growing which gives the group more fuel to trade higher.”

Zach continues: “Compared to other areas of the market, industrial stocks are still very cheap.”

Three companies Zach’s following?

Raytheon Technologies (RTX)

“RTX had a great earnings report last week,” Zach says, “beating Wall Street expectations.

“RTX pays a 2.35% dividend yield. If you buy shares today, you'll pay just about 17.6 times 2022 expected earnings. That's well below valuations for many other areas of the market,” he notes.

United Parcel Service (UPS)

“The business generates a lot of cash each quarter. And that cash is being used both to pay down debt and also to pay dividends. Investors currently receive a 2.13% yield,” says Zach.

“The stock's recent pullback gives you a chance to buy this quality company at a discount. Shares are now trading near 16.5 times next year's expected earnings.”

Honeywell International (HON)

“The stock is hitting new highs and is a big part of what is driving the overall industrial sector higher.

“Its recent earnings report showed two areas of surprising strength,” he says, in its energy and business automation divisions.

“The stock is a bit more expensive than other industrial companies, trading at 29 times this year's expected earnings. But with profits set to grow in years ahead, that multiple is starting to look a bit more reasonable.”

Zach concludes: “All three stocks look like great investments thanks to strong earnings reports.

Add to that: “The industrial sector has been posting more job openings than other groups,” he says. “This tells us that these companies are gearing up to expand in the weeks ahead!”

Market Rundown for Wednesday, August 4, 2021

The S&P 500 is down 0.32% to 4,409.

Oil’s down almost 3% to $68.47 for a barrel of West Texas crude.

Gold is up over 1% to $1,834.90 per ounce.

Bitcoin is up 2.25% to $39,055.

Send your comments and questions to, TheRundownFeedback@StPaulResearch.com

We’ll have more to say Friday; until then, take care…

For The Rundown,

Aaron Gentzler

Editor, The Rundown

TheRundownFeedback@StPaulResearch.com

Americans First

Posted July 03, 2025

By Matt Insley

Could Trump Deport Elon?

Posted July 02, 2025

By Matt Insley

The Daredevil in Pink Tights

Posted June 30, 2025

By Matt Insley

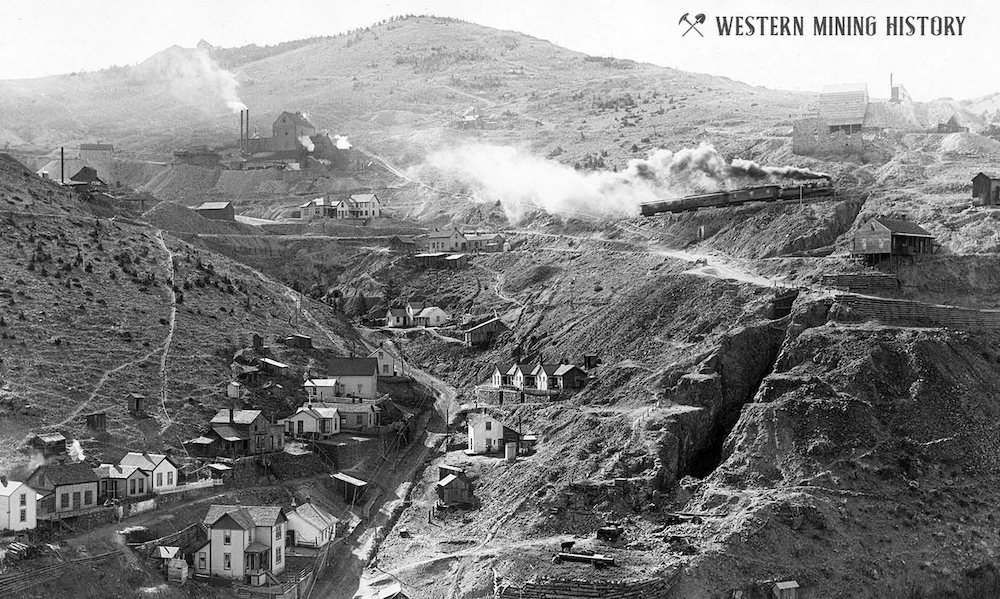

Star Geologist On “Birthright” Companies

Posted June 27, 2025

By Matt Insley

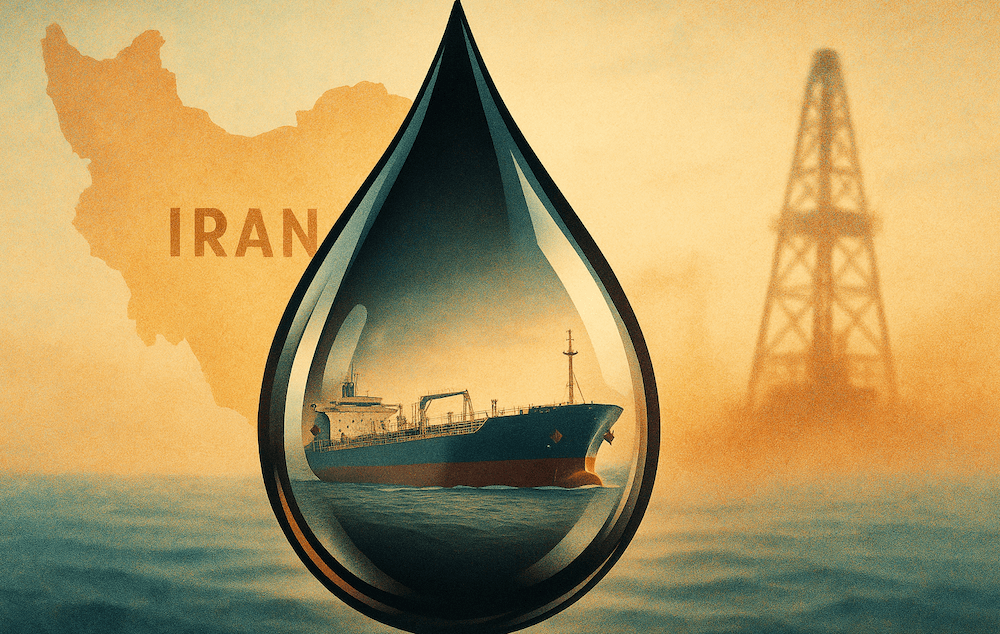

Iran’s Energy Chokepoint: Strait of Hormuz Fallout

Posted June 25, 2025

By Matt Insley