Posted June 05, 2023

By Matt Insley

Short People (Part 2)

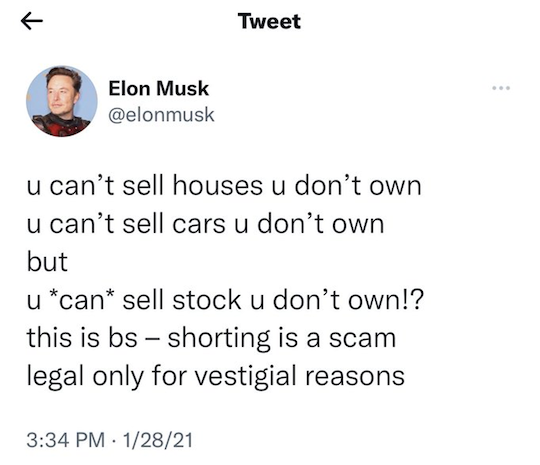

Every company that gets heavily shorted whines about it. Look at this 2021 tweet from billionaire Elon Musk apropos of Tesla being a favorite stock to short…

But short sellers serve an important market function. “Short sellers borrow shares from a broker and then sell them in the open market. Eventually, they have to buy the shares back and give them to the lending broker,” Paradigm’s editor Zach Scheidt explains. .

“When the market trades lower and traditional investors are afraid to buy, short sellers are among the first buyers to step in and support stock prices.”

In essence, short sellers function as a sort of market circuit breaker: “The more shares are held short, the more natural buying power there is to help stop a falling market,” Zach concludes.

Which brings us to the Biden administration’s latest campaign: In early May the American Bankers Association (ABA) appealed to SEC Chairman Gary Gensler this month. “We urge the SEC to investigate this behavior.

“Some of our members have experienced significant short sales of their publicly traded equity securities that do not appear to reflect the issuers’ financial status or general industry conditions.”

You remember what’s been happening in the banking industry this year, right? In March, we had one of the most significant bank crises since the 1980s.

“Targeting short-sellers would be counterproductive,” says The Wall Street Journal’s conservative-leaning Editorial Board.

“A 2012 New York Federal Reserve study found that the SEC’s temporary ban on short-selling of financial stocks in 2008 failed to halt bank stock price declines and raised trading costs by $500 million.

“Markets function better when there is more liquidity and price discovery, not less.”

Much like the banking crisis, this story ain’t over — we’ll keep you posted. In the meantime, Zach Scheidt pokes a hole in a market “truism”...

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Monday, June 5, 2023...

Debunking A Market Adage

“Sell in May and go away…

“It's one of the most well-known Wall Street sayings,” says Zach. “And the stats seem to back this saying up.

“Bespoke Investment Group published a report showing that the average returns from May to October have been 3.6% while the average returns from November through April have been 8.7%.

But with technological advances, “the sell in May wisdom is quickly becoming irrelevant.

“I'm seeing some very exciting opportunities in the market that should add some great returns to your wealth in the summer months,” says Zach.

Some of Zach’s favorites? Value stocks…

“These are stocks of companies that have reliable profits. And they’re stocks trading at a very low price compared to the level of earnings generated.

“These stocks typically give you:

- Less risk — because you're already paying a low price for the earnings you receive

- More income — because most value stocks pay reliable dividends and are trading at low prices compared to the income you receive

- Reliable returns — because they are a long-term investment.

“These are three great reasons to own stocks in this category,” Zach says. “And there are dozens of great companies to pick in the technology, manufacturing, health care, consumer staples and more.

Zach concludes: “As we head into the ‘soft period’ for markets, these names are picking up momentum and driving the overall markets higher.

“It's a trend that I expect will gain momentum.”

Market Rundown for Monday June 5, 2023

S&P 500 futures are stuck at 4,280.

Oil is up 1.7% to $72.98 for a barrel of WTI.

Gold’s down 0.50% to $1,958.90 per ounce.

And Bitcoin is down 1.70% to $26,750.

Send your comments and questions to, feedback@newsyoucanacton.com

RINOs Frustrate Trump’s Agenda

Posted December 16, 2024

By Matt Insley

JFK Assassination File: RFK Jr’s Quest

Posted December 13, 2024

By Matt Insley

The Rise of Kash Patel in Trump’s Inner Circle

Posted December 11, 2024

By Matt Insley

The Battle for America’s Bitcoin

Posted December 09, 2024

By Matt Insley

Trump Picks New Defense Secretary?

Posted December 06, 2024

By Matt Insley