Posted May 22, 2020

By Byron King

Stimulus Loopholes & Strategies

Dear Rundown Reader,

I am OK with helping people who have lost their jobs during these difficult times, says our first contributor. But big corporations with their slick legal departments are finding loopholes and grabbing portions of federal stimulus money for themselves.

I am against the government bailing out corporations to save them. Let them fail. Others will take their places. In the end, hard work and the smart use of capital make for success.

As for the second stimulus bill thats stalled out in Congress, a reader says

The motivation for Democrats to propose such a ludicrous idea is clear: it is 100% compatible with the Cloward-Piven strategy.

Possibly the most extreme example yet of not wasting a good crisis.

In 1966, Cloward and Piven -- two Columbia University professors -- published an article The Weight of the Poor: A Strategy to End Poverty.

Their premise? If every American eligible for welfare put in claims, state and local governments would be strained to the breaking point, requiring the federal government to come to the rescue.

The solution to poverty, according to Cloward and Piven, was federally-sponsored universal basic income (UBI), and a united Democratic party would be a byproduct.

Hmm Think our contributors onto something?

Send your opinions to, TheRundownFeedback@SevenFigurePublishing.com.

Your Rundown for Friday, May 22, 2020

Silver Stars

After making the case for silver last week, a reader writes: Can you suggest one of the better silver ETFs?

Hold that thought

For an update on silver, The Wall Street Journal says: Silver prices are surging, making the metal one of the markets best-performing assets in the second quarter, with investors seeking havens that can hold their value during times of economic uncertainty.

So back to our readers question, the two best-performing silver ETFs this year are Aberdeen Standard Physical Silver Shares ETF (SIVR) and iShares Silver Trust (SLV).

Comparing the two, both ETFs operate as grantor trusts, meaning shares are 100% backed by silver bullion held in vaults.

The ETFs, however, differ markedly in two respects: assets under management and 3-month average daily volume.

Whereas SLV has $6.6 billion under management, SIVR has only $418.2 million. And SLV trades at an average daily volume of 27,685,368 while SIVR trades at just 397,686. As for performance in 2020, SIVR has the edge over SLV -- 4.5% versus 4.2%.

The Wall Street Journal concludes: With many analysts expecting market volatility to persist, demand for physical silver bars and coins has gone up, while exchange-traded funds like the iShares Silver Trust have posted big inflows.

Today, we took some time to answer our readers question but for our money, we think theres a better silver play than ETFs. More on that Wednesday.

Market Rundown for Friday, May 22, 2020

The S&P 500 Index futures are up 3 points to 2,940.

Oil is down $1.25 to $32.67 for a barrel of West Texas Intermediate.

Gold up $15.80 to $1,737.70 per ounce.

Bitcoin is up $103.44 to $9,171.13.

Send your comments and questions to, TheRundownFeedback@SevenFigurePublishing.com.

Were taking Memorial Day off, but well be back Wednesday. Take a moment Monday to remember those from the U.S. armed forces who died in service to their country.

For the Rundown,

Aaron Gentzler

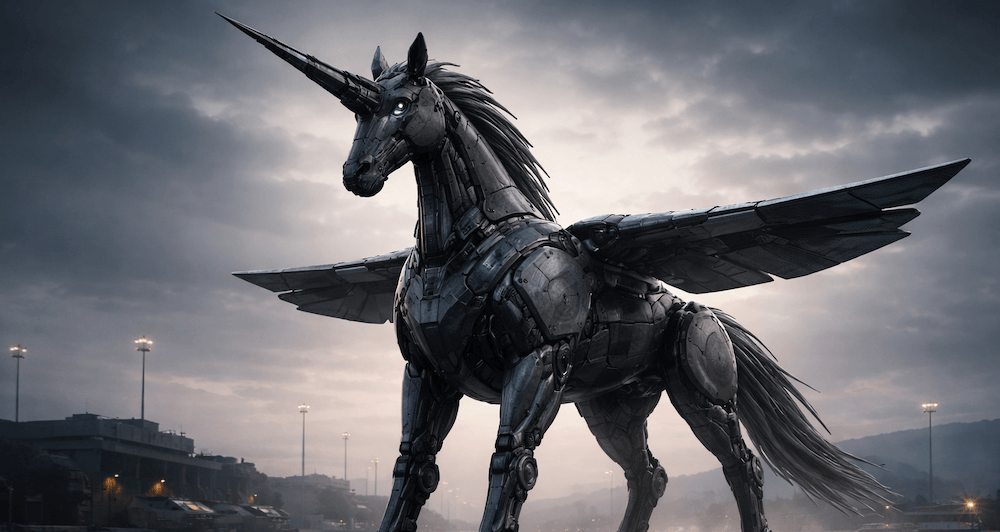

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley

The Ring Cam’s AI Surveillance

Posted February 11, 2026

By Matt Insley

Make Shame Great Again

Posted February 09, 2026

By Matt Insley