Posted January 19, 2026

By Matt Insley

Texas-to-California Pipeline Moves Forward

For years, California has told itself that higher gasoline prices are a tolerable trade-off, that scarcity can be managed and that imports will always fill the gaps when supply tightens.

Those assumptions are cracking.

Gasoline prices in California are the highest in the continental U.S. — second only to Hawaii in the nation. In many metro areas, $5 has become ordinary, not exceptional.

The root cause? California is stranded.

No pipelines cross the Rockies. There's no fast route to move fuel from the Midwest or Gulf Coast refineries. When production falters, the state has one option: wait for ships.

And that wait is getting longer. Last summer, California's fuel imports climbed to 279,000 barrels per day — the highest level since June 2021. About 70% of those imports, around 187,000 barrels per day, arrived from South Korea and other Asian suppliers.

Every additional tanker compounds the same problems: higher costs, longer delays and exposure to geopolitical risks California cannot control.

The timing couldn't be worse. Phillips 66 closed its Los Angeles refinery by the end of 2025, and Valero plans to shutter its Benicia facility in April 2026.

Together, these closures eliminate almost 20% of the state's refining capacity. With each shutdown, the system loses another buffer against disruption.

Which explains why a pipeline far from California's border has suddenly become urgent.

Your Rundown for Monday, January 19, 2026...

A Pipeline Could Change the Equation

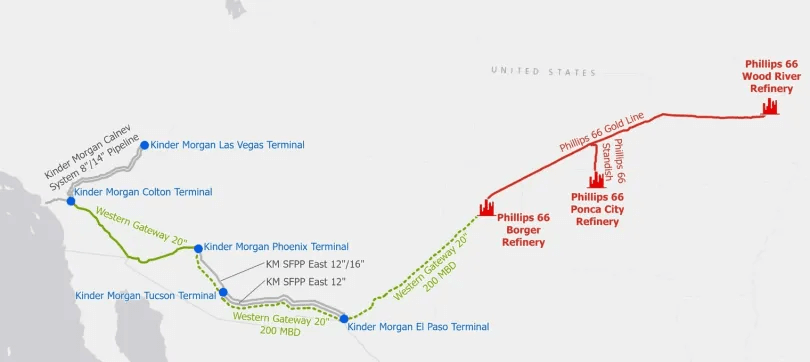

Phillips 66 and Kinder Morgan are pushing forward with the Western Gateway Pipeline — a 1,300-mile system that would channel refined products from the Midwest and Texas toward Arizona, Las Vegas and Southern California.

The project combines new construction with reversals of existing pipelines, creating what California has never possessed: a direct overland link to lower-cost U.S. refineries.

In October 2025, the companies launched an initial “open season” to gauge shipper interest, closing it in December 2025. The response was substantial enough that a second round will launch in January 2026 to allocate remaining capacity.

“That's a strong indicator that people would be willing to commit to put volume on that pipeline," says David Hackett, president of Stillwater Associates, a transportation-energy consulting firm in Irvine. “They won't build this thing on spec. They'll need commitments from shippers to do this.”

If constructed, Western Gateway would draw fuel from hubs in Borger and El Paso, Texas, into Arizona. From there, products would flow west toward California by reversing sections of Kinder Morgan's SFPP pipeline and Phillips 66's Gold Pipeline.

Source: Phillips 66, San Diego Union-Tribune

Worth noting: The plan requires no new pipeline construction inside California. Kinder Morgan has emphasized this distinction.

“With no new builds in California and using pipelines currently in place, it's an all-around win-win — good for the state and consumers,” says spokesperson Melissa D. Ruiz.

The appeal is straightforward: stability. A pipeline keeps more fuel in the region, reduces dependence on transpacific imports and gives California leverage it currently lacks.

“I'd much rather have our gas come from Texas or Missouri than from Asia, at least from a geopolitical strategic standpoint,” Hackett notes, pointing to escalating tensions in the South China Sea.

That observation captures what's actually at stake here. California's energy conversation is usually framed as climate policy versus oil industry interests.

The pipeline question is different. It's about resilience. After years of refinery shutdowns, mounting imports and vanishing margins for error, the market is hunting for pressure relief.

Western Gateway still faces years of permitting, regulatory gauntlets and legal challenges. Nothing is certain.

But the interest it has already drawn delivers an unmistakable message: California's fuel isolation is becoming untenable, and for the first time in years, there's a serious proposal to change that.

The market is closed today in observance of Martin Luther King Jr. Day — so no market notes. We’ll catch up with you Wednesday!

AI’s Y2K Moment

Posted February 25, 2026

By Matt Insley

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley