Posted October 18, 2022

By Matt Insley

The “60/40” Portfolio (Storm of the Century)

There’s a truly shocking chart I had to share, so be sure to read on below to take a look.

But before we get to market news, check out what your fellow Rundown readers have to say about Elon Musks’ Starlink in Ukraine.

“I'm totally opposed to any U.S. involvement in the war between Russia and Ukraine. Starlink, losing money in Ukraine, does not encourage both parties to go to the negotiating table, but increases the suffering of the Ukrainian people, and prevents my Starlink subscription from costing less. Follow the good advice of George Washington regarding foreign entanglements.”

Another reader was more sympathetic to the cause, but has grown skeptical…

“What Elon Musk did by donating Starlink services to Ukraine was a strong humanitarian gesture to a people in dire straits. However, time has proven that the government authorities are just as corrupt as Russia, if not worse.”

And, in a show of how far The Rundown readership stretches around the globe, we have a contributor with a Ukrainian email address (Ukrainian Catholic University, to be precise), with a simple message…

“Allowing Ukraine to use Starlink for free is greatly appreciated! Thank you.”

Send your opinions to, TheRundownFeedback@StPaulResearch.com

100-Year Storm

Sean Ring nailed it in this morning’s edition of Paradigm’s Rude Awakening…

“As you know, we reside in Clown World. It’s a place where up is down, left is right, and the truth lies.”

That perfectly sums up the mood on Wall Street, where stock prices react to an endless supply of bad economic news with big gains.

The S&P 500 jumped 2.65% yesterday and futures are up another 2.21% as I write this morning.

I’ll let our macro expert Jim Rickards, with his half a century's worth of experience in the markets, explain why this is not the signal to jump back into stocks…

“A new narrative did take over market psychology,” he says. “The narrative is a version of the old saying, ‘bad news is good news.’ Traders said that the more extreme version of Fed tightening expected would kill inflation faster than expected and set the stage for interest rate cuts early next year…

“Those expected rate cuts would be good for stocks, so it makes sense to buy stocks now!”

That’s what the bulls are saying, but “this narrative is nonsense for several reasons,” Jim warns.

“The first is that the Fed has made it clear they have no intention of cutting rates anytime soon. Inflation may come down, but the Fed’s target rate is 2% and the current 8.2% is still a long way away.

“The second problem is that if the Fed actually did cut rates early next year, it would not be a sign of success but a sign of dismal failure. It would mean that the economy was in a severe recession, which would be awful for stocks.”

Not great.

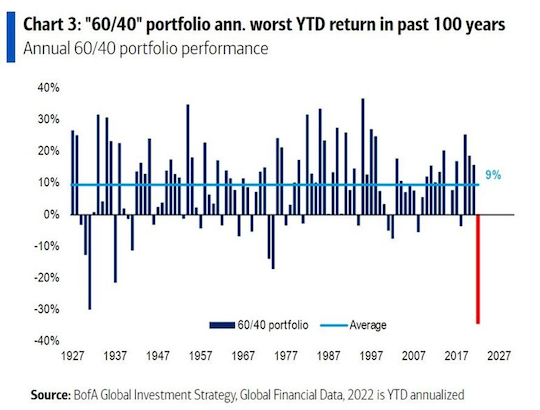

And then I saw this chart, which got me thinking about Main Street Americans doing their best to be responsible with their money…

The classic 60% stocks, 40% bonds portfolio has had its worst YTD returns in 100 years.

That’s the conservative allocation, designed to protect folks nearing retirement from big stock declines.

And experts like Jim — people with a proven track record of correctly predicting financial crises — say there’s more pain to come.

So let’s just say, if you haven’t diversified out of stocks yet, even after a rough year so far, it’s not too late to diversify into other assets.

In case you’re wondering, I already have!

Market Rundown for Tuesday, Oct. 18, 2022

S&P 500 futures are up 2.20% to 3,770.

Oil is down 1.4% to $84.31 for a barrel of WTI.

Gold is down $3.60 per ounce to $1,660.40.

And Bitcoin is up 0.40% to $19,600.

Send your comments and questions to, TheRundownFeedback@StPaulResearch.com

Trump Owns Democrats Again

Posted January 14, 2026

By Matt Insley

California Killed the Middle Class

Posted January 12, 2026

By Matt Insley

Nvidia Haters Are Seething

Posted January 09, 2026

By Matt Insley

Okay, I Get Why Robots Have Two Legs

Posted January 07, 2026

By Matt Insley

Buck Sexton on Venezuela

Posted January 05, 2026

By Matt Insley