Posted June 23, 2025

By Matt Insley

The Essential “American Birthright” Playbook

“I’d like to invest, but I don’t know the first thing about where to begin,” a reader writes. “What should I look for if I want to buy mining stocks?”

So many of you have written asking how to spot the next big opportunity in mining, and how to avoid the pitfalls. Well, you’re in the right place.

This issue is fueled by your feedback, and we’re here to help you turn curiosity into confidence.

Because mining isn’t just about moving rocks and dirt. It’s the foundation of modern civilization.

We’re just scratching the surface, but every semiconductor… smartphone… vehicle… and even the grid that powers the nation… rely on the minerals and metals miners pull from the earth.

In short, mining isn’t just another sector: it’s ground zero for economic power and independence.

As Jim Rickards highlights in his “American Birthright” thesis, our future prosperity hinges on securing our own sources of these critical resources.

So, if you’re looking to invest in real-world assets, and not just digital abstractions, mining stocks offer direct access to own a piece of the future.

Yes, Jim and his team have a thoroughly vetted list of specific recommendations for you.

But our guidance today will show you how to spot the best opportunities — whether you’re looking at giants of the industry or scrappy explorers…

Your Rundown for Monday, June 23, 2025...

The Essential “American Birthright” Playbook

Step 1: Know Your Players — Majors vs. Juniors

Think of major mining companies as the titans of the industry. These include BHP, Rio Tinto and more — household names with global reach, deep pockets and the muscle to weather storms. They pay dividends, they’re stable and they’re the backbone of the global supply chain.

On the other hand, junior miners are the wildcatters, the dreamers, the risk-takers. They’re out there mapping the ground, putting together the geologic clues, thinking hard and eventually drilling, all in the hope of making the next big discovery.

Many projects will never play out; it’s the nature and economics of the business. But those that do can deliver life-changing returns — especially if they’re bought out by a major. This is where the real excitement (and real risk) lies.

Step 2: The Ultimate Checklist for Mining Stocks

Don’t just throw money at any mining stock and hope for the best. The winners in this space stand out because of their discipline and attention to detail. The same goes for successful investors.

So, here’s what you should look for:

- Rock-Solid Financials: No matter the size, the best mining companies have strong balance sheets and low debt. For juniors, this means enough cash to survive the long road to production.

- Battle-Tested Management: The best leaders have been through the ups and downs of the industry. They know how to find value and avoid costly mistakes.

- Safe and Stable Jurisdictions: The last thing you want is a great project in a country where the rules change overnight. Stick to places where the rule of law is strong and mining is welcome.

- Commodities with a Future: Invest in the metals and minerals that the world needs — copper for electrification, rare earths for tech and so on. The energy needed for AI, to cite another example, is just getting started; demand is poised to explode.

- Production and Potential: For majors, look for steady output and big reserves. For juniors, watch for steady progress and the potential for a major to swoop in. (I’ll expand on this topic below.)

- Value vs. Price: The best opportunities are when the market cap is far below the value of the resources in the ground. This gives you a margin of safety and the chance for explosive upside.

Step 3: Fine-Tune Your Strategy

For Majors:

These are your steady portfolio anchors. They’re not flashy, but they’re reliable. The big guys have operations that generate steady cash flow and few surprises. Look for companies with diversified plays, strong dividends and low costs. They’re the best way to bet on the long-term demand for minerals without losing sleep at night.

For Juniors:

This is where the magic happens! The right junior can multiply your investment many times over if they hit it big with a new discovery. But you have to be smart: only invest in juniors with strong management, solid funding and projects in safe jurisdictions. Watch out for hype; focus on real value and tangible progress.

Final Thoughts: Seize the Moment

Jim Rickards’ “American Birthright” isn’t just an investment theme — it’s a wake-up call. The world is changing, and the companies that provide the raw materials for transformation are going to be the real winners.

Mining is more than just a stock sector; it’s a bet on American ingenuity and self-reliance. And a chance to be part of the next great economic revolution.

If you want to invest with conviction… if you want to be on the right side of history… and if you want to build real wealth… mining stocks demand a place in your portfolio.

And the time to act is now. Before the rest of the world catches on.

Market Rundown for Monday, June 23, 2025

S&P 500 futures are down a fraction of a percent to 6,015.

Oil is up 0.70% to $74.35 for a barrel of WTI.

The price of gold is up 0.20% to $3,391.30 per ounce.

And Bitcoin’s up 2.15% to $101,240.

We’re Crash Test Dummies Now

Posted October 24, 2025

By Matt Insley

ROTFH: Rolling on the Floor Headless

Posted October 21, 2025

By Matt Insley

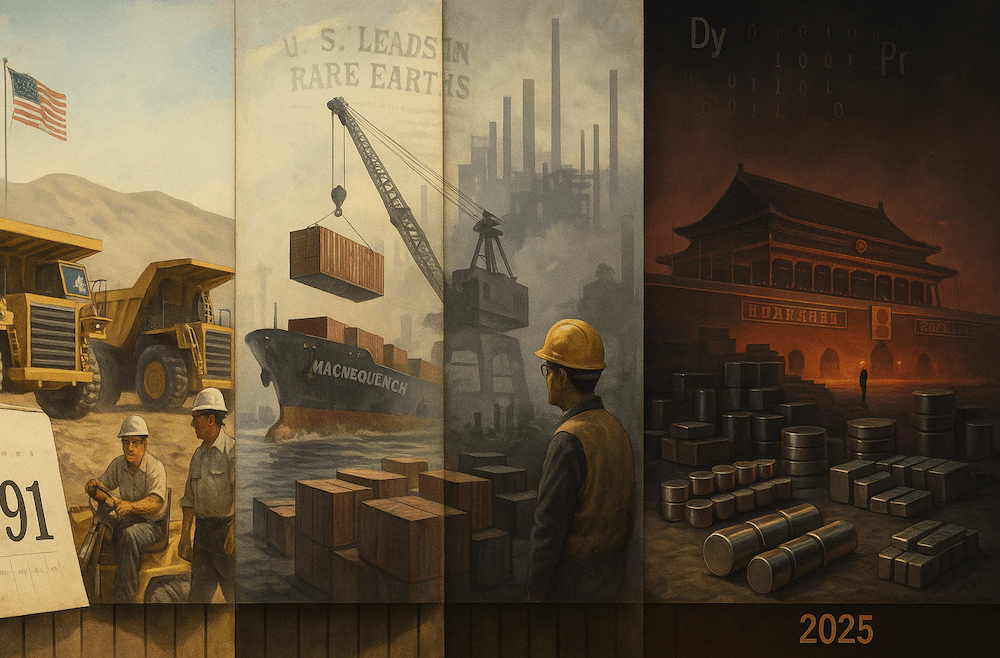

1991 → 2025: How China Won Resource Dominance

Posted October 20, 2025

By Matt Insley

Rare Earth Risks

Posted October 17, 2025

By Matt Insley

Jim Rickards: The Climate Cover-Up

Posted October 15, 2025

By Matt Insley