Posted January 23, 2026

By Matt Insley

The Great SaaS Meltdown

Software-as-a-Service (SaaS) has been one of the hottest tech sectors of the last 15 years.

Investors fell in love with the business model. And for good reason.

SaaS companies churn out recurring revenue, quarter after quarter.

They sell their services to businesses, and in many cases these companies depend on their SaaS vendors to run core functions.

For example, Salesforce (CRM) is a classic SaaS company. They sell the customer relationship management (CRM) software which companies use to manage, track, and grow customer relationships.

SaaS products often create a strong “lock-in” effect, meaning it’s very hard for customers to switch to a competing product.

When your whole business model depends on a specific SaaS platform, it’s difficult and expensive to move to a different provider.

So the best SaaS companies have always traded at a premium to the broad market.

But suddenly SaaS stocks are crashing, and investors want nothing to do with them. The reasons why might surprise you.

Your Rundown for Friday, January 23, 2026...

From Disruptors to Disrupted

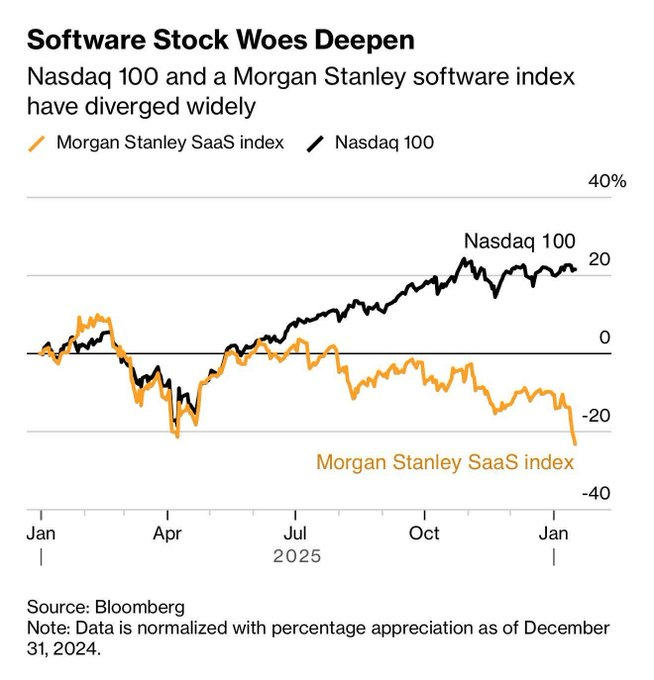

The Nasdaq 100 remains near all-time highs. Nvidia and other hardware companies are absolutely hitting it out of the park lately.

Meanwhile, SaaS stocks are quietly crashing, down more than 20% since summer.

Take a look at some top SaaS names and their recent performance:

Oof.

Part of the reason these stocks are selling off is, ironically, due to AI.

AI-assisted coding allows skilled programmers to increase their productivity by 10x.

And a big concern emerging now is that instead of paying SaaS vendors, companies will build their own internal software using AI coding tools.

So the fear is that instead of paying Salesforce massive sums of money each year, companies will build their own internal CRMs using AI.

These fears are probably overblown. Even with AI assistance, building a SaaS replacement is no small task. It needs to be enterprise-grade, secure, and reliable enough to run a business on.

Right now, AI coding simply isn’t reliable enough. However, the market is forward-looking so it’s possible this will become a major threat in a few years.

However, the other problem with SaaS companies is more immediate and serious: their high valuations.

Take a look at Figma (FIG), previously one of the hottest SaaS companies in the world. Figma makes collaborative visual design products which compete with Adobe.

Customers love Figma, and investors did too. Until recently.

Figma has fallen 80% from its 2025 peak. Growth is strong at 38% YoY, so what happened?

Figma’s share price got way ahead of its fundamentals. Despite being down 80%, it still trades at 13x revenue. That’s pricey.

The company’s forward P/E ratio is 67. And over the past 12 months it lost around $900 million at a $13 billion market cap.

That’s expensive, even after an 80% drop.

With companies like Google and Nvidia churning out cash flow, investors are no longer willing to accept high growth stocks that are bleeding cash.

They’ve experienced the wonder that is high growth AND high profitability. And so the appeal of fast growers losing billions of dollars is fading.

Short-term, Figma could rebound. But to become a reasonably-priced company, it either needs to keep growing at 35%+ a year for another 5 years, or come down in price even further.

From Software to Hard Assets

One other factor is playing a role in the SaaS meltdown. And that is the remarkable commodity boom that’s just begun.

Gold and silver are leading the way, as they typically do. But now copper and nickel are also on fire, and our friend Jim Rickards believes this is just the beginning.

Some investors are rotating from speculative tech names like Figma and into hard assets. They’re moving out of the cloud, and down into the earth where real tangible assets lie.

And now the Trump administration has thrown their support behind U.S. companies mining critical minerals.

Market Rundown for Friday, January 23, 2026

S&P 500 futures are down a fraction to 6,940.

Oil’s up 1.85% to $60.45 for a barrel of WTI.

The price of gold is up 0.55% to $4,940 per ounce.

But Bitcoin is down 0.30% to $89,200.

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley

The Ring Cam’s AI Surveillance

Posted February 11, 2026

By Matt Insley

Make Shame Great Again

Posted February 09, 2026

By Matt Insley

SAAS STOCKS CRASH

Posted February 06, 2026

By Matt Insley

CA’s New Surveillance Tax

Posted February 04, 2026

By Matt Insley