Posted March 16, 2022

By Matt Insley

The Great Stagflation

Dear Rundown reader.

“Ukraine hasn't used biological or chemical weapons yet, and the country is in a dire situation which makes me think they don't have them,” a reader writes.

“Russia has used them many times in the past,” he continues, “so they have a proven track record. Seems very likely to be a false flag by Russia.”

To be clear, we’re not certain Russia has used bio or chemical weapons many times.

On a small scale, however, it seems the GRU (Russia’s version of the CIA) used chemical weapons to eliminate dissidents, including defector Sergei Skripal and his daughter four years ago. More recently in 2020, activist Alexei Navalny survived a poisoning, presumably at the hands of Putin’s henchmen.

Of course, Russia denies any wrongdoing, but what is clear is Russia was a strong ally to Syria’s Bashar al-Assad who is accused of carrying out dozens of chemical attacks against his own people.

Update: Just hours ago, Ukraine’s President Zelenskyy indicated a “compromise” with Russia might be close. Fingers crossed.

Send your opinions to, TheRundownFeedback@StPaulResearch.com

Your Rundown for Wednesday, March 16, 2022...

1970s, Inflation/Stagflation

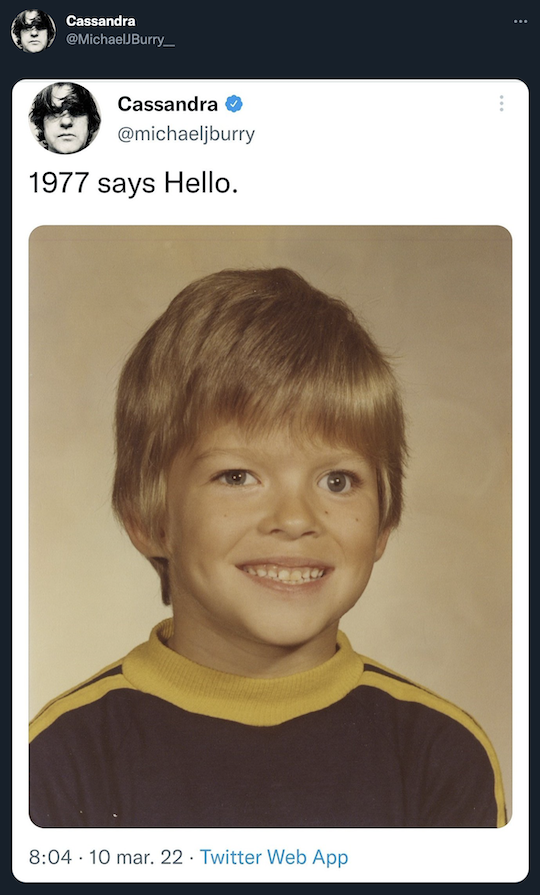

After a three-month social media hiatus, acclaimed “Big Short” investor Michael Burry tweeted…

You might know Burry as the heavy-metal loving investor – portrayed by Christian Bale – in the movie version of Michael Lewis’s bestseller “The Big Short.”

In real life, Burry’s hedge fund Scion Capital bet against the housing market in 2005, eventually making Burry about $100 million richer… and enriching Scion Capital investors by more than $700 million.

His latest tweet? “A reference to the period… in the 1970s, when the U.S. entered a recession but the inflation rate topped 12%, thanks to an oil embargo, and the effect of monetary and fiscal policies,” says Business Insider.

Which ushered in a period of stagflation – scorching-hot inflation alongside slow economic growth. “Before that, experts believed price rises would cool if an economy slowed, as it would dampen demand.”

The “experts” were dead wrong. Which is why we’re turning to macro authority Jim Rickards who’s worked with two presidential administrations, the Federal Reserve, the CIA and the Pentagon.

But now Rickards wants to enlighten everyday Americans about information once reserved for DC insiders – showing investors like you how to protect themselves and profit from the economic perils to come.

Market Rundown for Wednesday, March 16, 2022

S&P 500 futures are up1.4% to 4,310.

Oil is up 0.40% to $96.82.

Gold is down $5.60 to $1,924.40 per ounce.

And Bitcoin’s up 2% at the time of writing to $40,490.

Send your comments and questions to, TheRundownFeedback@StPaulResearch.com

We’ll be back Friday. Take care…

For The Rundown,

Matt Insley

Publisher, The Rundown

TheRundownFeedback@StPaulResearch.com

The First 72 Hours: Ayatollah Is Dead

Posted March 02, 2026

By Matt Insley

Jim Rickards: Before You Trust the Odds, Read This

Posted February 27, 2026

By Matt Insley

AI’s Y2K Moment

Posted February 25, 2026

By Matt Insley

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley