Posted July 19, 2024

By Matt Insley

The Innovation Rotation

“I do not necessarily condone Crooks’ actions,” says our first contributor today. “But I do understand it.

“Everyone seems to think that the assassination attempt was some kind of tragedy. However, Trump is the one saying he would be a dictator on his first day in office. Who thinks it would end on the first day?

“If you think the Constitution is worth saving, Trump returning to the White House would be a real tragedy.”

Wow, I’m almost at a loss for words.

It wasn’t just former President Donald Trump’s ear that was impacted by events in Butler, PA on Saturday.

Thomas Crooks shot an innocent bystander in the head — with his family looking on. Two other men were seriously wounded.

Not to mention, the U.S. Constitution you’re so quick to defend, guarantees some basic human rights for Trump and Corey Comperatore, for you and me. Taking top billing? Life.

I’d like to include more reader feedback today, but in the interest of time, I’ve got to move on. But before I do…

Tune in Monday to read more scorching feedback that begins: “Insley...What nonsense!”

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Friday, July 19, 2024...

(Investor) Patience is a Virtue

“The illusive bull market rotation we’ve patiently waited for is finally materializing,” says Paradigm’s pro trader Greg “Gunner” Guenthner.

“It’s also worth noting that despite this newfound rotation, the ‘biggest of the big’ stocks haven’t stalled out just yet:

- The VanEck Semiconductor ETF (SMH) is still sporting a year-to-date gain over 50%

- The NYSE FANG+ Index also remains a force to be reckoned with, as it sits on a year-to-date gain of almost 35%

- The S&P 500 Index is sitting right near its all-time highs and is up only 18% so far this year.

“While the leaders are still clinging to their gains,” Gunner says, “we’re finally seeing key breakouts emerge in some forgotten corners of the market.

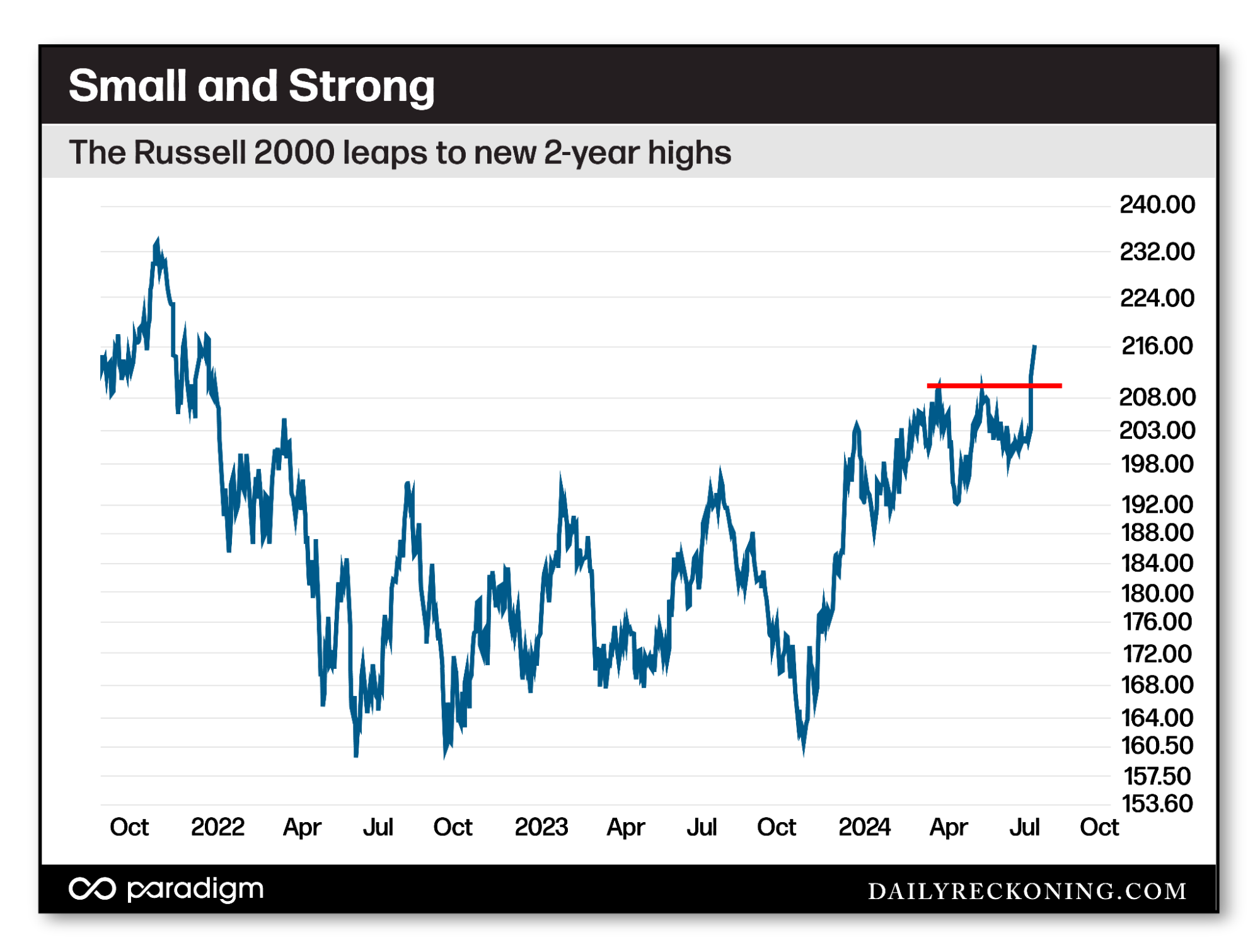

“My favorite (and strongest!) move unfolding right now is the monster breakout in the small-cap Russell 2000” — with biotech stocks leading the way.

“Frankly, small caps have been a mess for months,” he adds. “We’ve witnessed not one but two false breakouts so far this year as the Russell 2000 badly lagged the major averages.

“That all changed late last week when a midweek surge shot the iShares Russell 2000 ETF (IWM) back above $200… and it hasn’t looked back yet.

“Remember, the Russell 2000 has grossly underperformed the major averages for nearly two years,” Gunner says.

“That’s an incredible move for these stubborn, formerly range-bound small caps!

“Now that IWM has stabilized and is approaching its 2021 highs, more traders and investors will feel comfortable buying back in,” says Gunner.

“If the rotation theme continues to play out, we could see the smaller stocks outpace the big boys — even if the major averages decide to take a break.

“The move has been dramatic,” he says. “After all, no one was really expecting it. Despite the fact that some of these stocks are short-term overextended, we think they’ll soon consolidate and offer alert traders solid entry points.

“Now we’re finally seeing a powerful breakout that could take these small stocks much higher,” Gunner says.

“Are these our new market leaders as the third quarter begins in earnest?

“A funny thing happens when a down-and-out stock sector starts to break out,” Gunner says. “First, no one believes it. But as the breakouts expand, you’ll begin to hear some bullish whispers…

“That’s exactly what’s starting to happen.”

Market Rundown for Friday, July 19, 2024

The S&P 500 is slightly in the red at 5,540.

Oil is down 1% to $81.93 for a barrel of WTI.

Gold is down 2.40% to $2,397.70 per ounce.

But Bitcoin is up 1.75% to $64,700.

Send your comments and questions to, feedback@newsyoucanacton.com

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley

The Ring Cam’s AI Surveillance

Posted February 11, 2026

By Matt Insley