Posted October 27, 2025

By Matt Insley

The Most Underowned Bull Market in the World

Gold’s run has been stunning this year.

Through September 30, 2025, physical gold is up roughly 47% year-to-date, and gold mining stocks have surged more than 122% — far outpacing the S&P 500’s 13.7% gain.

Stretch the timeline out 3, 5 or 10 years, and the gap widens even more.

And yet — most investors still aren’t on board.

John Hathaway, an enduring voice in the precious metals space, argues the biggest opportunities are still ahead.

“The question isn’t whether gold has performed,” he notes. “It’s whether the move is over. In our view, the answer is no.”

Here are Hathaway’s five reasons why it’s not too late to own gold — and why today may be the moment to stake your claim.

Your Rundown for Monday, October 27, 2025...

Your Portfolio Needs a Hard Asset Backbone

#1 Gold’s Outperformance Hasn’t Attracted the Crowd Yet

Despite dramatic returns, gold remains a fringe asset for institutional portfolios.

For the past five years, mining stocks have mostly drawn only the deep-value contrarian types. The largest gold-miner ETF, GDX, is proof: Since 2024, GDX has experienced significant outflows.

That’s outflows during a bull market. Translation: This trade isn’t crowded. Far from it.

Hathaway says the sector is only just emerging from a multi-year consolidation. In his words, miners are shifting from “pariah status to momentum plays.”

When the broader market catches on, the upside should be powerful.

#2 Gold Is Tiny in a World of Trillions

Talk about underrepresentation:

- Gold miners’ combined market cap: ~$550 billion

- Global equity market: ~$128 trillion

- Gold miners’ share: just 0.43%

Back in 2011 — the last major gold boom — that share hit 0.7%. Now we’re at the lowest level since 1900.

Meanwhile, the “Magnificent Seven” tech giants made up 34% of the S&P 500 (as of mid-August, 2025) by themselves. If capital even slightly rotates out of Big Tech into gold, the impact would be seismic.

As Hathaway puts it: “Crowded? Overbought? Overheated? Those descriptors do not hold water.”

#3 Bonds Are Out. Gold Is In.

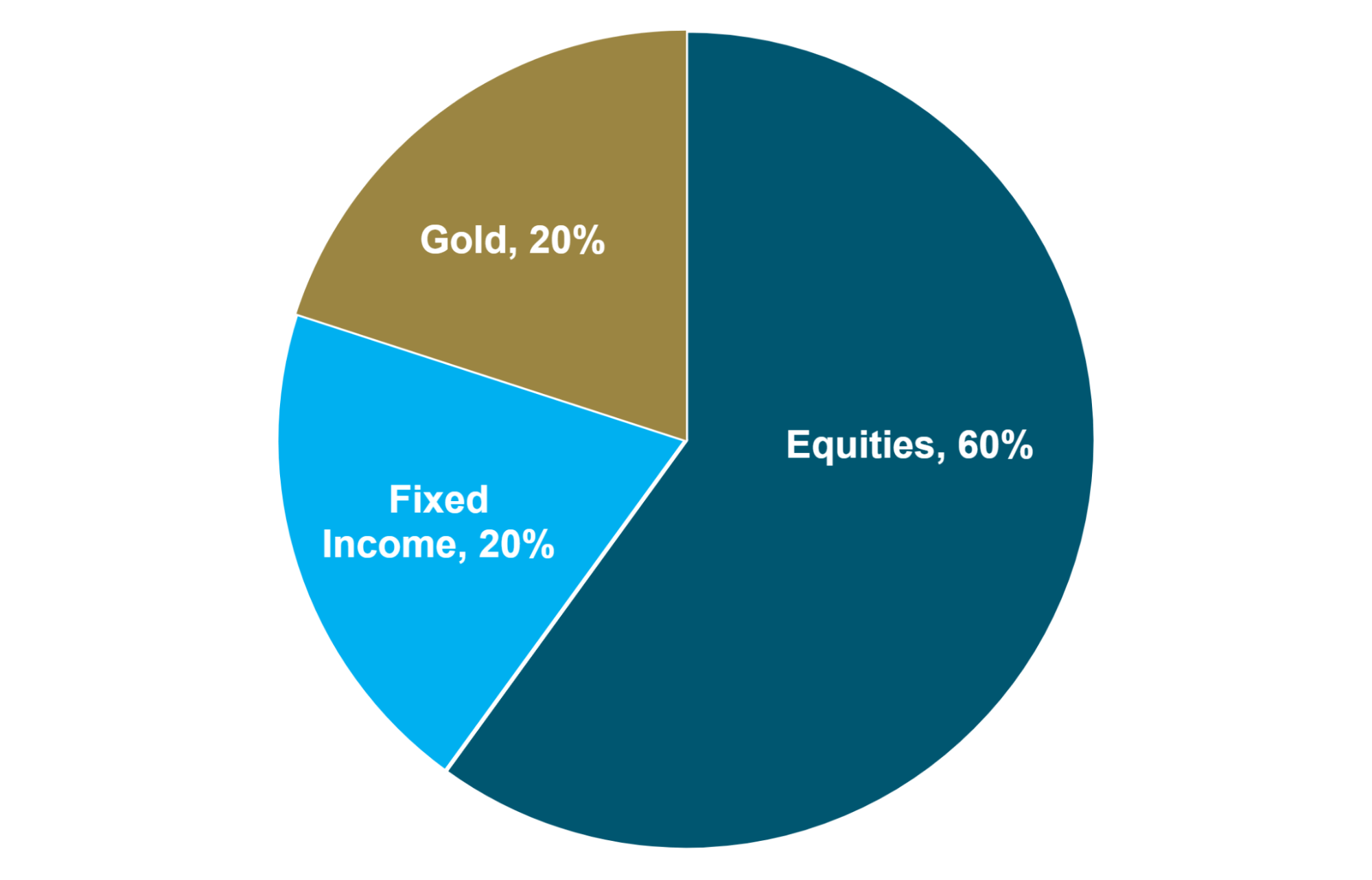

The old 60/40 portfolio is creaking.

Morgan Stanley’s CIO Mike Wilson has already suggested a 60/20/20 model — shifting 20% to gold.

Goldman Sachs echoes the logic, citing the failure of bonds to hedge equity risk in recent years.

Source: Morgan Stanley, Sprott.com

Gold serves two key roles:

- Physical Gold: Portfolio hedge/long-term store of value

- Mining Stocks: Leverage to rising gold prices (alpha potential)

Hathaway argues miners still have major catch-up potential because cost-inflation concerns have slightly eased — and margins expand rapidly when prices rise.

#4 Mining Companies Have Grown Up (Finally)

A decade ago, miners blew money on reckless acquisitions — chasing production at any cost. Shareholders suffered.

Not anymore.

Hathaway says management quality has “improved significantly,” thanks to:

- Better capital discipline

- Technology-driven efficiency

- Higher focus on returns and buybacks

- Scarcity of new high-grade discoveries

Executives are no longer empire-builders. They’re stewards of capital — and that shift can dramatically improve equity performance in a bull cycle.

#5 Active Management Can Unlock the Big Winners

Gold miners are not a monolith.

Over the last five years, there has been a staggering 171% performance spread between the best and worst-performing miners.

Hathaway argues that the right stock picking — focused especially on mid-cap and small-cap gems — could outperform passive ETFs by a wide margin.

In short: Broad exposure gets you the trend. Selective exposure gets you the jackpot.

Bonus: Silver Isn’t Just Tagging Along

Silver has been the late bloomer — until now.

- Up ~61% year-to-date through 9/30/25

- Hitting 15-year highs, flirting around 2011’s $49 peak

- Multiple years of physical supply deficits

- Gold-to-silver ratio still ~83:1 (long-term average ~67:1)

Chronic underinvestment means few new discoveries… but there’s growing demand from both investors and industries like solar, EVs and electronics.

If gold runs, silver historically runs faster.

The Bottom Line

The world is rediscovering something ancient: Gold is the ultimate risk antidote. And silver is its high-voltage sidekick.

With:

- Powerful price momentum

- Neglected sector positioning

- Smart, disciplined company management

- Growing institutional acceptance

- A potential silver squeeze

Hathaway believes the precious metals bull market is still in its “early stages.”

Paradigm’s own macro expert Jim Rickards agrees — and he’s long recommended a 10% portfolio allocation to precious metals (physical gold, silver and select miners). Not because it’s trendy… but because it’s prudent.

If you’ve been asking, “Did I miss the move?”

Hathaway’s answer is clear: Nope. You’re right on time.

Market Rundown for Monday, October 27, 2025

S&P 500 futures are up 0.80% to 6,880.

Oil is down 0.30% to $61.30 for a barrel of WTI.

Gold’s pulled back 2% to $4,050 per ounce.

At the time of writing, Bitcoin is up 1.40% to $115,185.

Department of War (Crimes)

Posted December 05, 2025

By Matt Insley

Americans Are Drowning All Around Us

Posted December 03, 2025

By Matt Insley

Trump Rewrites Ukraine’s Peace Plan

Posted December 01, 2025

By Matt Insley

Nvidia’s Uncertain Future

Posted November 26, 2025

By Matt Insley

Dead Men Can’t Trade

Posted November 24, 2025

By Matt Insley