Posted July 29, 2022

By Matt Insley

The $1.25 Store (Surviving Inflation)

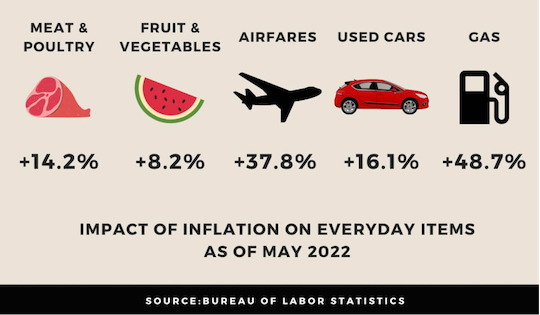

“Today's inflation is like jumping in the elevator and skipping higher by 20 floors,” says our retirement-and-income specialist Zach Scheidt.

“Suddenly the prices you have to pay are much higher than they were just a short time ago.” Yeah, speaking of sticker shock…

“Now, the money you've saved won't go as far as it used to. Even returning to a ‘normal’ rate of inflation means soon you'll need to pay more — on top of today's higher prices — for the things you need.”

In short? “Inflation causes the value of your savings to drop because it drives prices higher, diminishing savings’ purchasing power.

“Fortunately, there are some very good ways to beat inflation so that you wind up in a better position,” he says.

Send your opinions to, TheRundownFeedback@StPaulResearch.com

Your Rundown for Friday, July 29, 2022...

The Dollar Store

Here at The Rundown, one of our perennial favorite stocks has been Dollar General (DG). We’ve sung the company’s praises multiple times in the past. But hold that thought…

Among discount retailers, Dollar Tree (DLTR) has really delivered the goods, serving an underserved segment of the market, managing not only to survive but thrive as a brick-and-mortar retailer… And adjusting for inflation by tacking a quarter onto $1 price tags.

Just last week, Zach Scheidt discussed the pros and cons of retailers marking down excess inventory: “There's one area of retail that benefits from these lower prices.

“Companies like Dollar Tree (DLTR) and Dollar General (DG) buy excess merchandise from larger retailers.

“Now that traditional retailers have excess inventory to get rid of” — looking at you, WalMart! — “discount retailers can once again find bargains for their customers.”

“Expect to see more customers taking advantage of bargain prices from these discount retailers. And be on the lookout for strong earnings [and] rising stock prices.”

In fact, regardless of which way the economic wind blows, Dollar Tree might be one of the best stocks to own in case of a market downturn.

This was only reinforced by the company’s Q2 2022 earnings report on May 26; Dollar Tree reported several sound earnings beats, including $2.37 earnings-per-share versus $1.98 analysts anticipated.

Consensus opinion is that DLTR shares are significantly below fair market value, in short, Dollar Tree is a great stock to recession-proof your portfolio.

Market Rundown for Friday, July 29, 2022

S&P 500 futures are up 25 points to 4,095.

Oil is up 2.25% to $98.62 for a barrel of WTI.

Gold’s added $8.20 to its price at $1,767.10 per ounce.

But Bitcoin is in the red this morning, stuck at $23,725.

Send your comments and questions to, TheRundownFeedback@StPaulResearch.com

Take care and enjoy your weekend! We’ll be back on Monday.

For The Rundown,

Matt Insley

Publisher, The Rundown

TheRundownFeedback@StPaulResearch.com

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley

The Ring Cam’s AI Surveillance

Posted February 11, 2026

By Matt Insley

Make Shame Great Again

Posted February 09, 2026

By Matt Insley

SAAS STOCKS CRASH

Posted February 06, 2026

By Matt Insley