Posted March 25, 2024

By Matt Insley

Trump Tax (Cuts) Both Ways

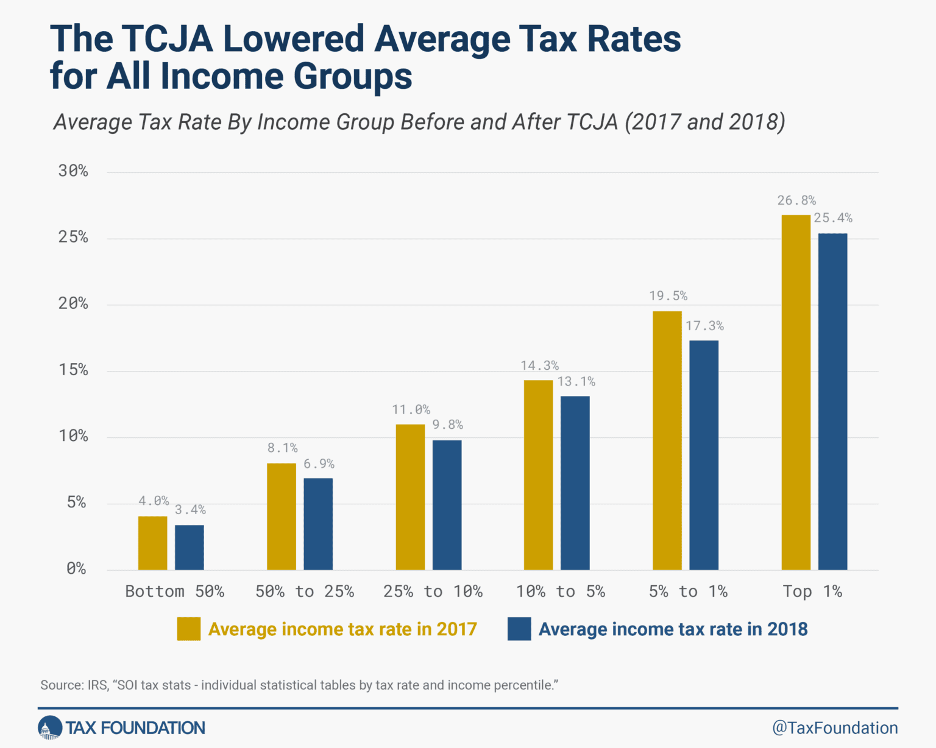

“Congress has less than two years to prevent tax hikes on the vast majority of Americans from taking place,” the Tax Foundation notes.

“That’s because the Tax Cuts and Jobs Act (TCJA) of 2017, a tax reform law that simplified individual income taxes and reduced tax rates across the income spectrum, is set to expire.”

Here’s how federal income tax rates changed after the passage of so-called “Trump tax cuts”...

“We estimate making the individual provisions of the TCJA permanent would reduce taxes for about 62% of filers, leave taxes unchanged for about 29% and increase taxes for just under 9% of filers in 2026.”

In fact, if Congress doesn’t intervene, you can see how your taxes might change when filing your 2026 return — TCJA expires for taxpayers on Dec. 31, 2025 — via the Tax Foundation’s handy calculator.

Fingers crossed?

Keep reading for why a permanent TCJA might be a two-edged sword…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Monday, March 25, 2024...

Gov’t Wants to Raid Your 401(k)

Dave Gonigam, managing editor at our sister publication Paradigm Pressroom’s 5 Bullets, outlines a scenario in which the Trump tax cuts are made permanent for most of us.

But politicians are going to need to scrape together revenue from somewhere…

And Dave believes they want to take it straight from…. your 401(k).

Dave has the 12-minute story — you can’t afford to miss — at our Paradigm Press YouTube channel.

While you’re there… subscribe! You don’t want to miss a moment of our up-to-the-minute content.

Market Rundown for Monday, March 25, 2024

The S&P 500 is down 0.24% to 5,221.83.

Oil’s up 1.46% to $81.81 for a barrel of WTI.

Gold is up 0.64% to $2,178.50 per ounce.

And Bitcoin’s up 1.23% to $68,029.50.

Send your comments and questions to, feedback@newsyoucanacton.com

AI’s Y2K Moment

Posted February 25, 2026

By Matt Insley

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley