Posted March 26, 2025

By Matt Insley

Trump’s Mineral Wealth Home Run

The United States and Ukraine are inching closer to a groundbreaking minerals deal that could reshape their economic and strategic partnership.

On Monday, President Trump announced that he expects to sign the agreement “soon” — signaling a potential thaw in relations after his heated exchange with Ukrainian President Volodymyr Zelensky last month.

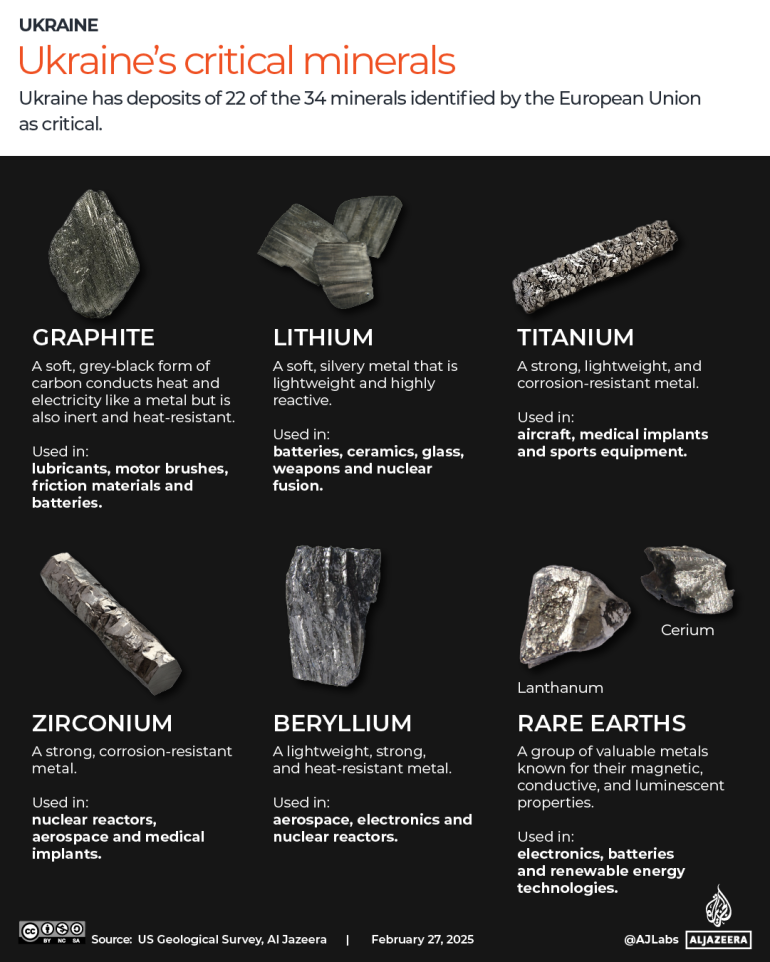

At the heart of this deal is Ukraine’s impressive mineral wealth.

The country boasts substantial reserves of critical resources like titanium, lithium, beryllium, manganese, gallium, uranium, zirconium, graphite and nickel.

Most notably, Ukraine holds the largest titanium reserves in Europe.

Source: U.S. Geological Survey, Al Jazeera

A 2023 study suggests these resources could be worth up to $14.8 trillion, positioning Ukraine as a key player in global supply chains and innovative technologies.

Your Rundown for Wednesday, March 26, 2025...

A New Era in U.S.-Ukraine Relations

But the path to this agreement has been far from straightforward…

Ukraine rejected previous versions due to a lack of concrete security guarantees.

The current agreement, while not providing explicit assurances, does include language supporting Ukraine’s prosperity and security.

Under the latest version, Ukraine would contribute 50% of future profits from state-owned resources, including oil, gas and logistics infrastructure. This fund would be reinvested annually to promote Ukrainian development.

While details are still being ironed out, the Ukrainian president emphasizes that the final agreement would still require approval from the Verkhovna Rada, Ukraine’s parliament.

Interestingly, the deal's scope has expanded beyond minerals.

Trump and Zelensky recently discussed Ukraine’s energy supplies and nuclear power plants during a phone conversation.

Trump suggested that U.S. involvement in running these plants could offer the “best protection,” though Zelensky clarified that ownership changes were not on the table.

As negotiations continue, both nations seem eager to find common ground.

With Ukraine’s vast mineral wealth at stake and the U.S. seeking to secure critical resources, this deal could mark a turning point in their relations.

Market Rundown for Wednesday, March 26, 2025

S&P 500 futures are flat as of writing, at 5,826.

Oil’s up a tick at $69.60.

Gold sits at $3,032 this morning.

And Bitcoin is up a little less than 1% at $87,949.

The 401(k)-Shaped Economy

Posted March 09, 2026

By Matt Insley

All For It, Dead Against It, Deeply Uneasy

Posted March 06, 2026

By Matt Insley

MTG vs. AOC

Posted March 04, 2026

By Matt Insley

The First 72 Hours: Ayatollah Is Dead

Posted March 02, 2026

By Matt Insley

Jim Rickards: Before You Trust the Odds, Read This

Posted February 27, 2026

By Matt Insley