Posted October 25, 2024

By Matt Insley

Trump’s Tax Reforms Expire on Dec. 31, 2025

If you have a strong conviction about the election’s outcome — and some extra cash on the side — there’s a platform for that (which, by the way, requires a crypto wallet).

So we said in our August 9th issue, spotlighting Polymarket: the go-to digital forum where bettors can place simple yes/no wagers on the potential outcomes of real-world events.

Under Polymarket’s U.S. elections category, for example…

Speaking of election odds, we learned yesterday that a French trader, using four Polymarket accounts, placed over $28 million in bets on Donald Trump winning the 2024 U.S. presidential election.

“Wagers on the presidential election have taken off in this cycle,” says The New York Times, “especially after claims that these markets are better predictors of the White House race than traditional polls.”

But the NYT protests: “The seeming disparity between polls [and] the odds on prediction markets has raised questions about potential manipulation to paint an overly rosy picture about Trump’s prospects.”

It must be manipulation!

Not to be intimidated, Polymarket fired back yesterday: “Prediction markets are not opinion polls — they measure the likelihood of an event occurring rather than the percentage of people who intend to take an action.”

Moving on, today we’re taking a look at a cornerstone of Team Trump’s campaign. Namely? Taxes…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Friday, October 25, 2024...

TCJA: A Successful Track Record

At the heart of Trump’s campaign to strengthen the U.S. economy is a commitment to make the Tax Cuts and Jobs (TCJA) permanent, ensuring long-term tax savings for millions of Americans.

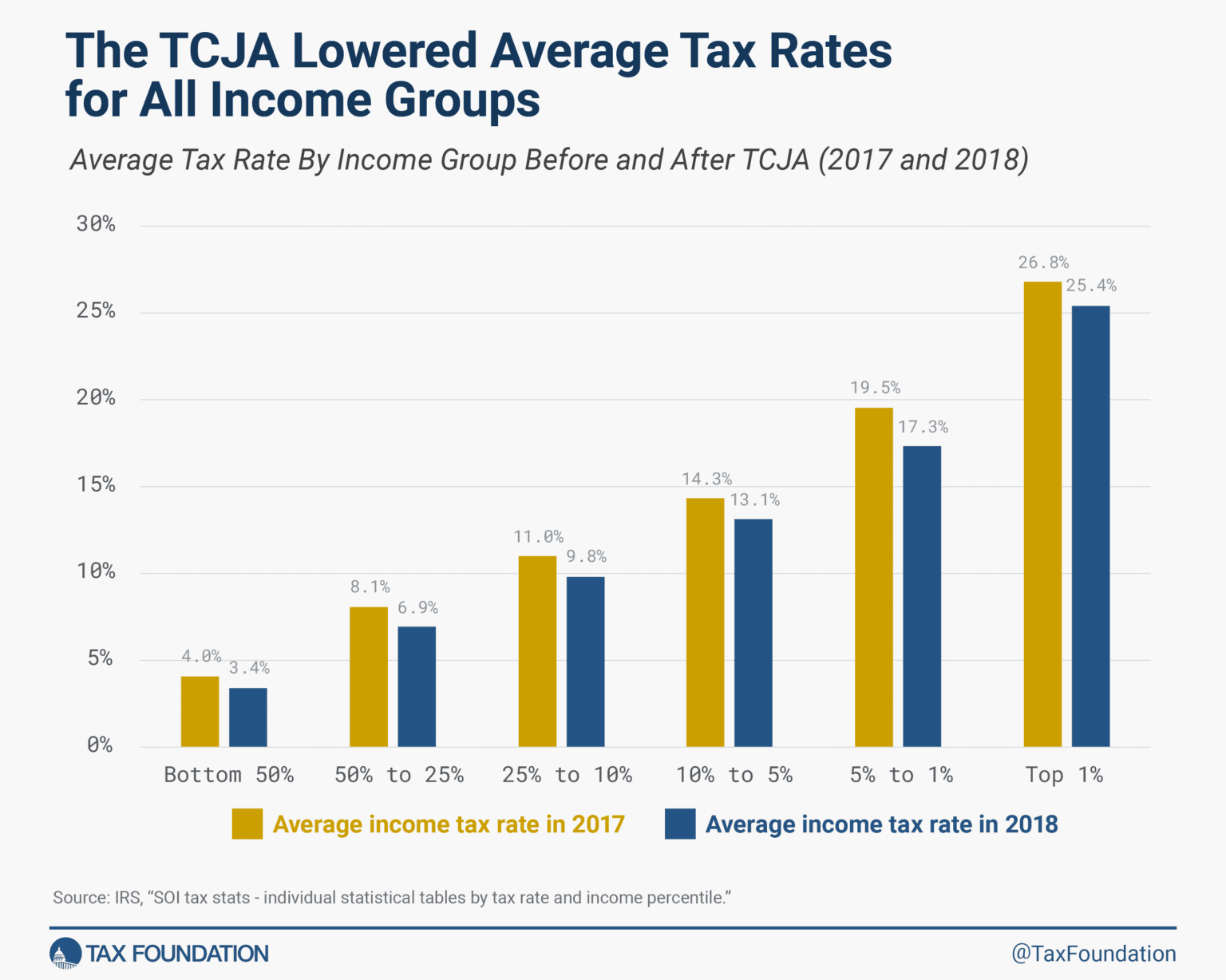

With many TCJA provisions set to expire in 2025, the Tax Foundation highlights Trump's “tax reform law [simplified] individual income taxes and reduced tax rates across the income spectrum.”

Here, in fact, is how federal income tax rates changed after the passage of the TCJA…

The Tax Foundation adds: “We estimate making the individual provisions of the TCJA permanent…

- “Would reduce taxes for about 62% of filers

- Leave taxes unchanged for about 29%

- And increase taxes for just under 9% of filers in 2026.”

[Via this handy calculator, you can see how your taxes might change when filing your 2026 tax return should TCJA provisions expire on Dec. 31, 2025.]

By making 2017 tax reform permanent, Trump says: “This will keep more money in the pockets of hard-working Americans and allow businesses to thrive.”

Accordingly, by extending the TCJA’s business-friendly provisions, Trump seeks to encourage business-and-job creation, particularly in the manufacturing sector.

Plus, in a bold proposal, Trump hastens to eliminate taxes on Social Security benefits, providing significant relief to retirees.

Trump's tax plan is part of a broader strategy to reinvigorate the American economy. By combining tax cuts with targeted policies to boost domestic production and reduce regulatory burdens, Trump aims to create a climate for American prosperity and opportunity.

Market Rundown for Friday, Oct. 25, 2024

S&P 500 futures are up 0.30% to 5,865.

The price of oil is up 1% to $70.90 for a barrel of WTI.

Gold is down 0.35% to $2,738.20 per ounce.

Bitcoin is likewise down 0.15%, just under $68,000.

Send your comments and questions to, feedback@newsyoucanacton.com

State of the Union Preview

Posted February 23, 2026

By Matt Insley

Elon: In A.I. We Trust

Posted February 20, 2026

By Matt Insley

War Unicorns: Adapt or Die

Posted February 18, 2026

By Matt Insley

Wall Street’s Secret Society

Posted February 16, 2026

By Matt Insley

Buck Sexton: Caracas Has Tehran’s Full Attention

Posted February 13, 2026

By Matt Insley