Posted September 16, 2024

By Matt Insley

WHO’S REALLY SHOOTING AT TRUMP?

A second assassination attempt on former President Donald Trump yesterday…

The animus against Trump is just off-the-charts.

This time, the FBI says a lone pro-Ukraine gunman set up at a fence outside Trump’s golf course in West Palm Beach, Florida.

“He hid in bushes and pointed an AR-style rifle with a scope at Trump, who was about 400 yards away, officials said,” CNBC reports.

This time, the Secret Service spotted the suspect, Ryan Wesley Routh, and opened fire. At which point, Routh fled. He was later arrested.

Did Routh fire on Trump? It’s still not clear.

But Speaker of the House Mike Johnson says: “Trump needs the most coverage of anyone. He’s the most attacked, he’s the most threatened, even probably more than when he was in the Oval Office.”

Johnson was actually meeting with Trump at Mar-a-Lago yesterday.

“So we are demanding in the House that he have every asset available, and we will make more available if necessary. I don’t think it’s a funding issue. I think it’s a manpower allocation,” Johnson concludes.

We’ll see if Trump’s security is fortified; of course, we’ll keep you updated in the days ahead.

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Monday, September 16, 2024...

How Aggressively Will the Fed Cut Rates?

The Federal Open Market Committee (FOMC) is scheduled to meet Tuesday and Wednesday, and the question occupying Wall Street’s collective brain:

How big is the rate cut going to be?

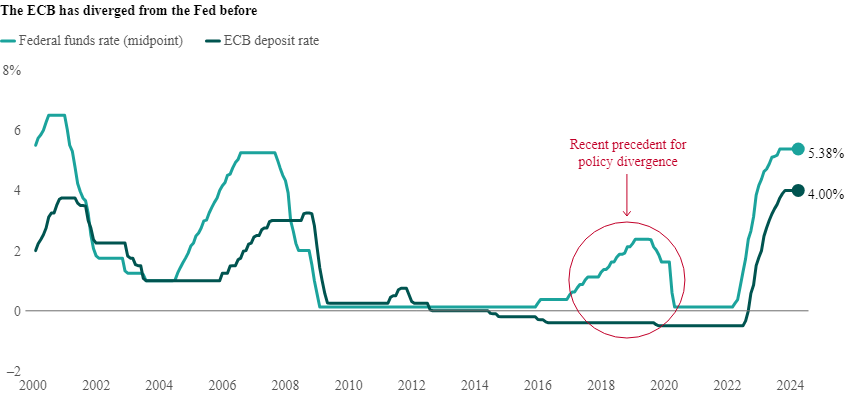

First thing I’ll mention, the European Central Bank (ECB) cut interest rates on Thursday — for the second time in three months.

Nevermind that “it's common for ECB policy to follow that of the Fed, often with a lag,” Vanguard’s chief economist Jumana Salaheen wrote in late April.

“There's a recent precedent of divergence between the two central banks…

“Toward the end of the last decade, the ECB cut rates slightly and expanded quantitative easing,” Salaheen notes, “while the Fed embarked on a rate-hiking cycle.”

Click to enlarge

Source: ECB, U.S. Federal Reserve, Bloomberg, Vanguard (as of March 31, 2024)

But who can remember pre-pandemic times?

Here’s a reminder…

The Federal Reserve maintained near-zero interest rates from 2009 until 2015.

Then the central bank — under Fed Chair Janet Yellen — implemented gradual 25 basis point hikes annually, accelerating the pace in 2017 and 2018, ultimately reaching a peak of 2.25-2.5%.

In 2019, under Trump appointee and current Fed Chair Jerome Powell, the Fed reversed course and cut rates three times to stimulate the economy amid low inflation and slowing growth. (Bet you didn’t remember that, right?)

“Until the coronavirus pandemic came along,” says an article at Bankrate.

- In March 2020: “The Fed slashed rates to zero across two emergency meetings within 13 days of each other as the gears of the economy came to a halt.”

- Two years later, the Fed raised rates in March 2022 to fight out-of-control inflation. Which led to more quantitative tightening from Powell and company in May and thereafter.

Currently? Rates have been paused between 5.25-5.5% since July 2023.

According to the CME FedWatch tool, there’s a 35% likelihood the FOMC will cut rates by 0.25% on Wednesday. At the same time, there’s a 65% likelihood of a 0.50% rate cut.

The Federal Reserve's decision on interest rates could significantly influence the 2024 election by impacting everyday Americans…

Have you applied for a mortgage recently? Or an auto loan?

Voters will remember those experiences when they step into the voting booth.

And the fate of Jerome Powell — whose term as Fed Chair expires in 2026 — will depend on the election’s outcome. (It’s no secret that Trump isn’t a Powell enthusiast, to put it mildly.)

The next president will have the power to nominate Powell's successor, influencing monetary policy for years to come.

Market Rundown for Monday, Sept. 16, 2024

S&P 500 futures are down 0.10% to 5,685.

Oil is up 0.85% to $69.24 for a barrel of WTI.

Gold is down slightly to $2,609.20 per ounce (setting another record).

Bitcoin is down 2.25% to $58,525.

Send your comments and questions to, feedback@newsyoucanacton.com

Sen. Rand: Musk for House Speaker

Posted December 20, 2024

By Matt Insley

Trump Calls for Drone Transparency

Posted December 18, 2024

By Matt Insley

RINOs Frustrate Trump’s Agenda

Posted December 16, 2024

By Matt Insley

JFK Assassination File: RFK Jr’s Quest

Posted December 13, 2024

By Matt Insley

The Rise of Kash Patel in Trump’s Inner Circle

Posted December 11, 2024

By Matt Insley